18 Apr TLR Week in Review: April 18, 2025

Welcome to this week’s edition of The Lonely Realist Week in Review. This week saw global markets whipsawed by escalating trade tensions and cautious central bank signals. A surge of new U.S. tariffs and retaliatory moves from trading partners dominated headlines, injecting uncertainty into business plans and policymaker meetings. Economic data painted a mixed picture: U.S. consumers front-loaded purchases ahead of looming price hikes, even as sentiment soured and growth slowed. Meanwhile, investors grappled with volatile financial markets – stocks stumbled, safe-haven assets like gold soared to records, and bond yields swung on fears of stagflation. We break down the key developments below.

Sponsored research brought to you by Centennial Quantitative.

This article is provided for educational and entertainment purposes only. It does not constitute financial or investment advice. Please conduct your own research and consult a qualified professional before making any investment decisions.

Politics

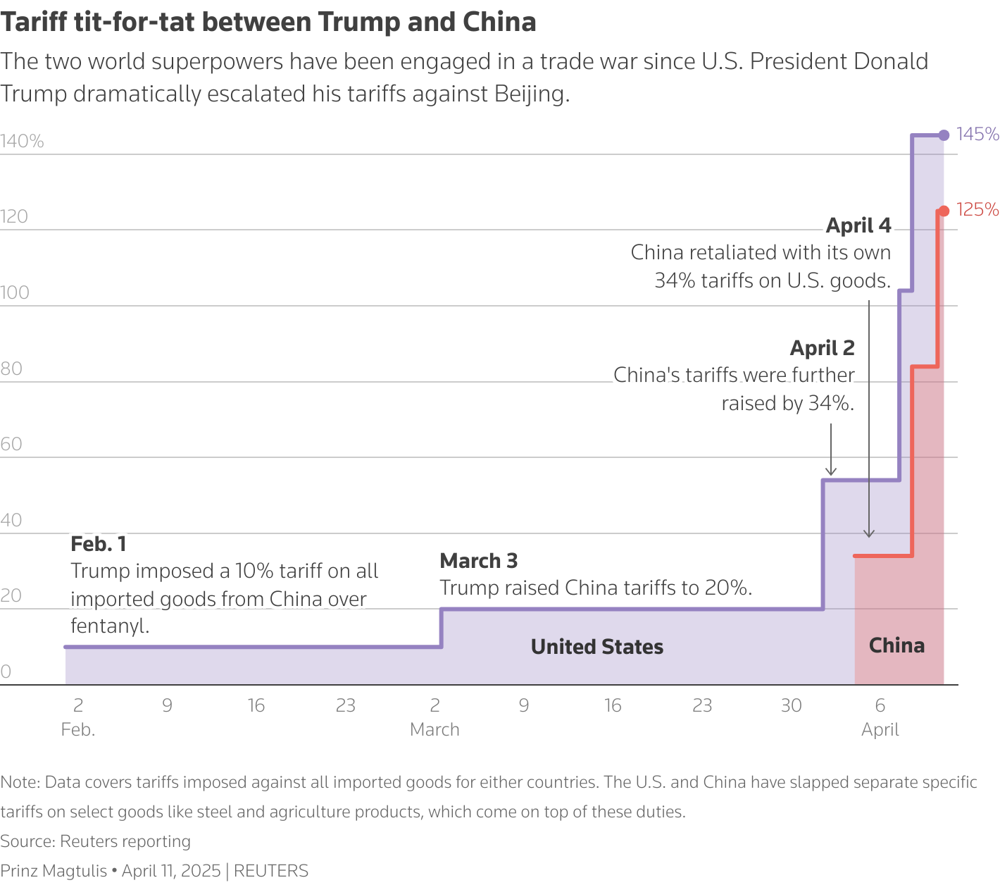

Tariff tit-for-tat between Trump and China. A step chart shows the rapid escalation of U.S. and Chinese tariff rates since February 2025.

Trade War Escalation: U.S. trade policy took a dramatic turn as President Donald Trump unleashed a “tsunami of new tariffs” on trading partners. In early April, the administration imposed a 10% tariff on all imported goods – a broad measure aimed at China and others – with even higher rates on specific items like automobiles. Notably, a 25% global tariff on cars and trucks took effect in early April, prompting warnings of significantly higher vehicle prices. China and the European Union swiftly retaliated in kind, raising their own import duties (in China’s case up to 125% on some U.S. goods). The two superpowers are effectively locked in a tariff tit-for-tat, as illustrated above, with China matching U.S. moves step for step. Amid “off the charts” uncertainty in trade policy, U.S. officials did offer some temporary relief on select items – for example, a planned electronics tariff was reportedly paused for 90 days to allow negotiations. Still, the administration broadened its scope, launching probes into pharmaceutical and semiconductor imports on national security grounds as a prelude to possible new tariffs. By week’s end, global finance leaders at the IMF meetings in Washington warned that these sweeping shifts in trade could inflict “significant” economic damage, urging a return to a fair, rules-based trading system. There is hope that ongoing talks during the 90-day tariff reprieve might cool tensions, but for now, trade war rhetoric is dominating the agenda of U.S. policy.

Domestic Developments and Fed Independence: The tumultuous policy environment spilled into U.S. domestic politics. President Trump escalated his public pressure on the Federal Reserve, lashing out at Fed Chair Jerome Powell in unusually direct terms. In a post on social media, Mr. Trump complained that Powell “should have lowered interest rates… long ago,” and remarked that Powell’s “termination cannot come fast enough,” reiterating his frustration that the Fed hasn’t aggressively cut rates. Such attacks – coming barely a quarter into Trump’s new term – have raised concerns about the Fed’s independence. Powell, whose term runs through 2026, responded indirectly by affirming that the central bank will “ignore political influence” and set policy based on economics alone. He also noted the Fed is monitoring a pending Supreme Court case regarding presidential power to fire independent agency officials, though he does not believe it will apply to the Fed. On Capitol Hill, bipartisan unease is evident as lawmakers warily assess the economic fallout of the trade conflict. While there were no major new fiscal policies this week, a potential debt ceiling battle looms in the background (the debt limit was reinstated in January), adding another layer of political risk for later this year. For now, the White House’s aggressive trade stance and vocal criticism of the Fed have set the tone in Washington, overshadowing other issues. Global allies and rivals alike are calibrating their responses: at the IMF Spring Meetings, IMF Managing Director Kristalina Georgieva diplomatically urged the U.S. and China to reduce uncertainty and stressed that “everyone suffers if financial conditions worsen” due to policy missteps. In sum, U.S. policy uncertainty – from tariff zig-zags to central bank tensions – was a key theme in politics this week, leaving investors and foreign leaders on edge.

Economics

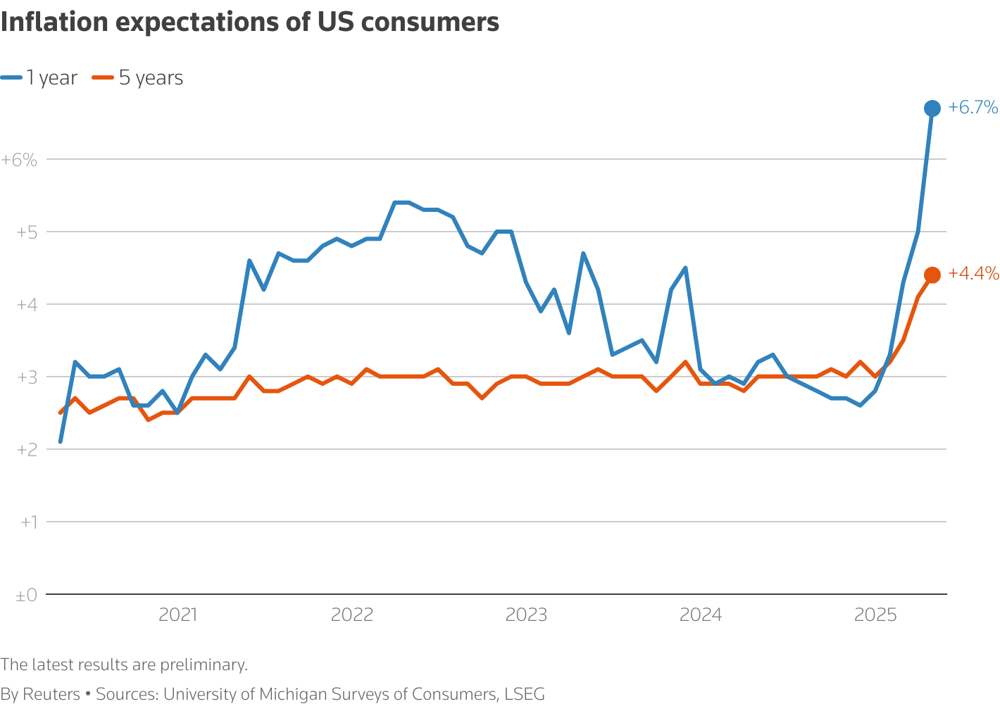

U.S. Macro Data and Stagflation Worries: The macroeconomic picture in the U.S. is turning more complex, as the data reflect both the stimulus and strain of the trade war. On one hand, consumer spending surged in March, with retail sales jumping 1.4% – the biggest monthly gain in over two years. This surprisingly strong figure was driven largely by Americans rushing to purchase cars, appliances, and other goods ahead of impending tariffs, effectively panic-buying to avoid expected price hikes. Auto sales spiked over 5% as buyers tried to “beat” the new car duties. Yet economists warn this is a one-time boost that “will probably fizzle in the months ahead as consumers hunker down,” in the words of one analyst. In fact, beneath the surface, cracks are showing. The University of Michigan consumer sentiment index plunged to near a three-year low as the tariff battle intensified. Americans’ confidence has been shaken by a darkening outlook and market volatility. Business surveys paint a similar picture of caution: manufacturing output rose modestly (+0.3% in March) and finished Q1 with a respectable 5.1% annualized growth, but forward-looking new orders are softening amid uncertainty. Perhaps most concerning, economists have been downgrading growth forecasts – real GDP for the first quarter is tracking below 0.5% (annualized) according to many estimates. Such an anemic pace, coupled with rising prices, has led to murmurs of stagflation. Indeed, Fed Chair Powell acknowledged this week that the economy “appeared to have slowed” and that “inflation is likely to go up as tariffs find their way [through]… some part of those tariffs [will] be paid by the public.” In other words, the Fed sees a risk of higher consumer prices even as growth cools – an unenviable scenario. Supporting that view, price indicators were mixed: the headline CPI for March (released last week) continued to decelerate, but underlying inflation remains above target, and this week the Producer Price Index unexpectedly fell – a sign that tariff-sensitive supply chain costs might be temporarily suppressed as firms postpone orders. However, inflation expectations have spiked. Short-term consumer inflation expectations jumped to multi-year highs in April (as shown below), reflecting the public’s belief that tariffs will make everyday goods more expensive in the near term.

U.S. consumer inflation expectations have surged (1-year ahead hit 6.7% in April, blue line) while longer-term expectations (5-year ahead, orange line) have also drifted up. Persistent tariff-related price increases are influencing short-term outlooks.

Policymakers are walking a tightrope. The Federal Reserve has adopted a wait-and-see approach in light of these cross-currents. In a speech mid-week, Chair Powell stressed that the Fed is “well positioned to wait for greater clarity” before adjusting interest rates. He noted the dilemma of potentially being caught between rising inflation and a weakening job market – a scenario in which both of the Fed’s mandates (price stability and full employment) could deteriorate due to the trade shock. For now, the labor market remains solid (unemployment is hovering around multi-decade lows), and weekly jobless claims, while edging up slightly, are still at historically low levels. But Fed officials have become more vocal that they will not preemptively rescue markets from volatility – Powell bluntly stated there is no “Fed put” for equity investors. This hawkish tone caught markets off guard. Stocks, which were already under pressure, extended losses after his comments, as investors realized the Fed might tolerate more market pain if inflation is rising. In essence, monetary policy is on hold for now, even as fiscal/trade policy is highly expansionary and erratic, creating a challenging environment for forecasting.

Global Economic Context: The U.S.-centric turbulence is rippling through the global economy. In its meetings this week, the International Monetary Fund warned that world growth is set to slow due to the trade conflict, though it does not yet foresee a global recession. The IMF is preparing to mark down its global GDP forecasts (previously 3.3% growth for 2025) to reflect “significant” consequences from this “reboot” of the trading system. Notably, both China and Europe have shown signs of strain. China’s export growth has weakened as tariffs bite, and analysts expect Beijing to roll out stimulus measures or monetary easing to “buffer its economy” if conditions worsen. In Europe, the outlook has darkened enough that the European Central Bank (ECB) took action this week: the ECB cut its policy rate by 25 basis points (the seventh cut of the cycle) to 2.25% and signaled willingness to ease further. The ECB cited “exceptional uncertainty” from global trade tensions hurting the fragile eurozone recovery. Euro area business confidence and industrial output have sagged under the weight of weaker exports and higher import costs, so policymakers in Frankfurt are pivoting back to stimulus mode. In contrast, the Bank of Japan appears to be on a different path – Governor Ueda indicated that if inflation remains on track, the BOJ will continue raising rates gradually (a notable shift after decades of ultra-easy policy)reuters.comreuters.com. This divergence underscores how the trade war is affecting regions unevenly: Europe and emerging markets are easing policy to counteract demand hits, while Japan battles a long-awaited rise in inflation. Meanwhile, one beneficiary of the turmoil has been India – the IMF applauded India’s recent moves to reduce trade barriers, and investors see India as potentially gaining export market share while the U.S. and China feud. Overall, the global economy is still growing, but momentum is slowing and downside risks are multiplying. A Reuters poll now puts the probability of a U.S. recession in the next year at 45% – the highest since late 2023 – and financial leaders warn that negative “perceptions” can become self-fulfilling. With that in mind, all eyes are on policymakers to see if diplomacy can mitigate the economic headwinds in the weeks ahead.

Market Trends

Equities Struggle Amid Volatility: U.S. equity markets endured a choppy, holiday-shortened week (markets were closed Friday for Good Friday). Major indexes lost ground overall, giving back last week’s gains. The S&P 500 fell about 1.5% for the week, while the Dow Jones Industrial Average dropped 2.7% and the Nasdaq Composite declined 2.6%. Notably, the Dow’s losses were exaggerated by a plunge in one of its largest components: UnitedHealth Group stock tumbled 22% on Thursday after the health insurer slashed its profit outlook due to rising medical costs. This sparked a broader selloff in health care shares – peers Humana and CVS Health fell ~5-7% in sympathy. Technology stocks, which had been market leaders, also faltered. Semiconductor stocks were hit especially hard mid-week after the U.S. announced new restrictions on chip exports to China, a move that threatens sales for industry giants. The Philadelphia Semiconductor Index dropped over 3% on that news, with heavyweights Nvidia and AMD each down sharply. Meanwhile, a few bright spots emerged: shares of Netflix rose after hours on a strong earnings report (the streaming giant beat subscriber and revenue estimates), and pharmaceutical maker Eli Lilly surged 14% after positive trial results for a weight-loss drug. But those were exceptions in a market dominated by macro forces. The primary drag on stocks was the macroeconomic backdrop – Wednesday saw a sharp selloff across the board after Fed Chair Powell’s comments and the export curb news, and despite a mild rebound Thursday, the tone remained risk-off. By the week’s close, the S&P 500 and Nasdaq were hovering near one-month lows, reflecting investors’ anxiety over trade policy and growth. In Europe, equity markets were somewhat more resilient. The pan-European STOXX 600 ended roughly flat for the week, as dovish signals from the ECB (rate cut and potential for more) helped offset the drag from trade worries. In Asia, Japan’s Nikkei and China’s CSI 300 both slipped amid the global volatility and concerns about reduced U.S. tech demand. Overall, market volatility stayed elevated – the VIX (Wall Street’s “fear gauge”) remains above its long-term average – as traders parsed every policy announcement for its impact on corporate earnings.

Bonds and Currencies: The U.S. Treasury market saw major swings. Early in the week, safe-haven demand and speculation about foreign selling drove yields to multi-year highs, before a modest pullback. The benchmark 10-year Treasury yield ended around 4.33%, up from 4.28% on Wednesday. In fact, over the past two weeks the 10-year yield has jumped about 50 basis points, a remarkable move for such a short span. Traders reported heavy volumes and stressed liquidity as everyone tries to reassess fair value amid the trade war. One factor pushing yields higher was concern that China may reduce its U.S. bond holdings in retaliation for American tariffs. There were rumors last week of significant Chinese selling, contributing to the 10-year yield’s largest weekly rise since 2001. This week, a pair of solid U.S. Treasury auctions (for 10-year and 30-year bonds) helped stabilize the market somewhat, but many investors remain wary. With inflation expected to tick up and the Fed not immediately coming to the rescue, longer-term bonds have been under pressure. Short-term yields have been steadier, as Fed policy is on hold for now – the 2-year yield is roughly flat on the week, anchored by expectations that the Fed will refrain from rate cuts in the near term. The net result is a flatter yield curve than a month ago (the curve had been inverted; it’s now inching toward normal as long yields rise). In Europe, German bund yields actually fell (~5 bps on the 10-year) to about 2.5%, reflecting a flight-to-safety within the eurozone and anticipation of ECB easing.

On the currency front, the U.S. dollar weakened further, extending a multi-week slide. The dollar index (DXY) dropped roughly 1% this week, and the greenback touched a three-year low against the euro and a six-month low against the yen. Investors are increasingly wary of U.S. assets given the unpredictability of trade policy and the erosion of yield advantage (as U.S. yields have been volatile and other central banks turn dovish). The Swiss franc – a traditional safe haven – strengthened significantly; the dollar’s exchange rate versus the franc is at its weakest since 2015. Market analysts noted an unusual dollar sell-off even on days when U.S. stocks fell, suggesting some global investors may be losing confidence in the U.S. policy environment. The Chinese yuan also depreciated to its softest level in over a year, as China’s central bank likely allowed some weakness to offset tariff impacts (while avoiding a disorderly move that might trigger capital outflows). Meanwhile, emerging market currencies broadly struggled under the twin pressures of a strong euro/yen and risk aversion – for instance, currencies like the Indian rupee and Brazilian real saw modest declines this week, though no EM currency crisis is evident at this stage. In summary, fixed income and FX markets are pricing in higher uncertainty, with a tilt toward safety away from U.S. assets: higher U.S. yields, a weaker dollar, and strength in safe havens are all part of that story.

Commodities and Safe Havens: Gold extended its remarkable rally, repeatedly punching into record-high territory. The precious metal is living up to its safe-haven status amid the current turmoil. Gold futures hit an all-time high of about $3,370 per ounce early Thursday before settling around $3,340. That marks roughly a 3% gain this week, on top of last week’s 6% surge. Bullion has climbed for six consecutive weeks as investors seek protection against inflation and geopolitical risks. Market strategists note that real interest rates (nominal yields minus inflation) are expected to turn more negative if inflation accelerates and central banks cut rates – a very supportive scenario for non-yielding assets like gold. In a similar vein, Bitcoin and other cryptocurrencies have seen renewed inflows; Bitcoin traded near $85,000, up about 4% for the week, in what some describe as “digital gold” behavior amid fiat currency skepticism.

In the oil market, prices rebounded strongly this week, aided by both supply and demand considerations. West Texas Intermediate (WTI) crude rose over 3%, ending around $64.50 per barrel. This builds on a recovery from last month’s lows around the mid-$50s. Several factors propelled crude higher: First, U.S. crude inventories drew down more than expected, indicating solid demand for gasoline and diesel as the summer driving season approaches. Second, OPEC+ producers have maintained supply discipline, and there are hints that Saudi Arabia will extend voluntary output cuts if prices falter. Additionally, there is a geopolitical risk premium creeping back – tensions continue in Eastern Europe (the Russia-Ukraine conflict is unresolved), and recent unrest in the Middle East has kept traders on alert, though no major supply disruptions occurred this week. On the demand side, some optimism that China’s stimulus measures (if implemented to counteract trade war pressures) could support oil consumption also helped lift sentiment. The result is that oil has shrugged off trade concerns for now, with traders focusing on traditional fundamentals. Industrial metals were more directly hit by the trade war narrative: copper prices slid about 1% this week, reflecting worries about slower global manufacturing activity ahead, and aluminum prices eased as well. Agricultural commodities remain a wild card – with new tariffs in play, U.S. soybean and corn exporters are facing uncertainty about Chinese purchases. Grain prices were choppy but ended little changed, as weather and planting progress in the U.S. also drove day-to-day moves. To sum up, commodity markets are bifurcated: energy is climbing on supply tightness, while trade-exposed commodities (metals, agriculture) are under mild pressure. Gold stands out as a star performer in this environment of uncertainty.

Forward Guidance

Looking ahead, market participants are bracing for more event risk and will be laser-focused on policy signals in the coming days. The Federal Reserve’s next meeting is in early May (May 7), and while no rate change is expected, investors will scrutinize the Fed’s statement and Chair Powell’s press conference for clues on how the tariff-induced crosswinds might alter the policy path. Earlier hopes of a rate cut later in 2025 have faded – Fed officials like San Francisco’s Mary Daly have suggested that rate cuts may need to wait until clear progress is made on taming inflation. The challenge for the Fed is significant: they must be prepared to act if financial conditions deteriorate sharply, but also avoid undermining their inflation-fighting credibility. Any hint in May’s meeting of a tilt back toward accommodation (or conversely, a firm stance against inflation) could swing both bond and equity markets.

On the fiscal and trade front, all eyes will remain on negotiations during the tariff truce. The 90-day window that paused some of the more punitive U.S. tariffs is ticking – roughly two weeks have passed with little public progress, so roughly two months remain for Washington and Beijing (and Brussels, Tokyo, etc.) to hash out new trade arrangements. Any headlines suggesting a compromise – for instance, China offering greater intellectual property protections or the U.S. carving out exemptions for key allies – would be market-positive. Conversely, signs that talks are faltering could spur another risk-off wave. Traders have learned to expect “lots of rumors and posturing” in this period. The G7 summit in June and other diplomatic forums could become critical venues if the impasse persists. Additionally, market observers are starting to keep one eye on the U.S. debt ceiling debate: while the X-date (when the Treasury exhausts cash) isn’t expected until late summer or early fall, political brinkmanship could heat up in the coming months, potentially affecting Treasury bill markets and investor sentiment if not addressed in a timely way.

Meanwhile, the economic calendar for next week will provide important updates on the state of the economy. The U.S. government is set to release its advance estimate of Q1 2025 GDP on April 30. With consensus expectations around an annualized +0.5% (and some forecasts even lower), a negative surprise could raise recession alarms, while a stronger number (say, 1%+ growth) might assuage some fears that the economy is stalling. Also on tap are reports on durable goods orders, consumer confidence, and housing data (new home sales and home prices). Investors will parse these for confirmation of the late-Q1 slowdown hinted by retail’s artificial boost. Importantly, April’s data will start to show the initial impact of tariffs – for instance, watch for any drop in auto sales and consumer spending in April now that prices are higher and the rush to buy early is over. The corporate earnings season will also kick into higher gear. Thus far, a majority of large banks and a few tech names have reported better-than-feared results (Q1 earnings overall are on track for modest growth). Next week brings several heavyweights from the technology and consumer sectors. Companies’ forward guidance on earnings calls could be the market’s canary in the coal mine: any trend of lowered revenue outlooks or margin pressure due to input costs/tariffs will be closely noted. Conversely, if companies emphasize resilience or the ability to pass on costs, it may bolster confidence.

Outside the U.S., central bank decisions will draw attention. The Bank of Japan meets at the end of April, and while no major change is expected, Governor Ueda’s tone will be watched in light of recent yen strength and above-target inflation – any tweak in yield-curve control or outlook could move global bond markets. In Europe, after this week’s ECB cut, further guidance on stimulus (perhaps via speeches or minutes) could influence the euro and European credit spreads. Additionally, geopolitical developments remain a wildcard. The conflict in Ukraine, U.S.-China relations beyond trade (such as Taiwan issues or tech sanctions), and OPEC’s monitoring of oil markets – all have the potential to generate headlines that jolt markets without warning.

In summary, investors enter the coming week with a cautious stance. The operative narrative is one of high uncertainty: policy-driven risks abound, and the range of potential outcomes is wide. Asset allocators at top institutions are emphasizing diversification and quality – a reflection of the unpredictable cross-currents in play. As one market strategist noted, “Trump continues to dominate the headlines and the financial markets… There will be lots of rumors and posturing.” In such an environment, expect continued volatility. The key questions for the weeks ahead include: Will cooler heads prevail on trade, or will we slip into a deeper global trade downturn? Can the U.S. economy withstand this storm without tipping into recession? And how long will the Fed and other central banks hold their nerve if markets get disorderly? By the next Week in Review, we should have more clarity on at least some of these issues. Until then, prudence and vigilance remain the watchwords on Wall Street.

No Comments