11 Oct Is President Trump’s Weak Dollar Wish Coming True?

“We are witnessing de-dollarization. Are we nearing a finale?” – The Lonely Realist

A Dollar is “fiat currency,” a piece of paper. It has no intrinsic value. People believe in it because they have faith in America’s economic and foreign policies, its judicial system, its Constitution, and its Rule of Law. From The Lonely Realist’s earliest commentaries, TLR has warned against actions that promote a weaker US Dollar. “Be Careful What You Wish For” was TLR’s 2019 warning against making the Dollar less attractive to global users. That has been a recurrent TLR theme. TLR’s concerns have only increased. This past March, in noting that “De-dollarization happens slowly…, then all at once,” TLR pointed out that President Trump’s and Vice President Vance’s America First policies are expressly targeting a weakened Dollar that would reduce the U.S. trade deficit and help U.S. manufacturers and exporters…, though not without consequences. How close is America to achieving the weaker Dollar goal?

China, Russia and their anti-American allies (TLR’s “Axis of the Sanctioned”) are big supporters of a weaker America Dollar. They favor de-dollarization (pressing for in-kind swaps (for example, of manufactured goods for commodities), with China promoting its Yuan as a Dollar alternative) and have spent more than a decade pursuing policies designed to undermine U.S. hegemony by chipping away at the Dollar’s “exorbitant privilege.” As the world’s reserve currency, that “exorbitant privilege” anchors American wealth and power. The Dollar’s dominance stems from America’s economic stability, widespread trust in U.S. institutions, and the Dollar’s use as a medium for international transactions (for example, through the SWIFT system). Its reserve currency status confers unfair well-earned tangible advantages on America’s government, its businesses and its citizens. It is that “exorbitant privilege” that has allowed America’s government to borrow at low interest rates (and spend the borrowings to benefit Americans and American businesses), run large trade deficits (thereby earning positive net income on its international portfolio even though it’s a net debtor), ensure domestic stability, and exercise global economic hegemony (a form of seigniorage – the real resources that foreigners must provide to the U.S. in order to use its Dollars). That is why America’s government has historically pursued a strong Dollar policy that benefits U.S. consumers and makes imports and foreign travel less expensive. The downside is that it also has made American exports less competitive (with the consequent (and now discredited) globalization and international economic integration).

As the global reserve currency, the Dollar has been the world’s safe harbor investment. Other countries therefore have stockpiled Dollars in order to manage their own currency’s value, facilitate international trade (settled in Dollars), repay foreign debt (denominated in Dollars), and protect against economic shocks and financial crises (backstopped by America’s Federal Reserve and its ability to print Dollars). The Dollar’s “exorbitant privilege,” inherent in reserve currency status, has eroded over the past decade+ as America’s global influence has waned. Weaponization of the Dollar as a means of punishing America’s enemies (using the Dollar as a sanctioning mechanism) rattled the Dollar’s stability. Doing so led other countries’ central banks to begin substituting gold for Dollars. That trend accelerated after America froze Russia’s foreign currency reserves in the wake of its invasion of Ukraine in 2022. Central banks and foreign governments, in search of something that adversaries couldn’t seize, began piling into gold.

The general public (together with foreign governments and professional investors) recently expressed the gravest of concerns by propelling the price of gold above $4,000/oz. Don’t let gold’s meteoric rise confuse you. It’s not evidence of a gold bull market. It’s evidence of de-dollarization: a bear market in Dollars (as well as other overly-indebted currencies).

The media is flush with alleged reasons for gold’s performance. Perhaps it’s President Trump’s trade war that has undermined faith in the U.S. as a stabilizer of the global economic order? Or the Federal Reserve’s decision to cut interest rates despite inflation running above 3%? Or President Trump’s efforts to seize control of everything monetary policy by firing Fed governor Lisa Cook? Or the President’s threat to send the National Guard to Blue States by resurrecting the centuries-old Insurrection Act? Or the partisan gridlock that prevents the re-opening of the U.S. government? Or the fear that President Trump will agree to a permanent expansion of healthcare subsidies that would cost $450 billion (which the government doesn’t have)? Or pending American civil war increasing political instability?

The rising prices of Dollar alternatives is a cumulative consequence of all of these…, and more. The prices of gold, silver and Bitcoin are increasing at unprecedented rates because of a rapidly eroding belief in the Dollar’s entitlement to “exorbitant privilege” (noting that the Dollar has lost 99% of its purchasing power relative to gold since 1913…, and >52% since 2022).

Ken Griffin, CEO of investment goliath Citadel, said earlier this week: “Sovereigns, central banks, individual investors around the world now say, ‘You know what? I now see gold as a safe harbor asset in a way that the Dollar used to be viewed. That’s really concerning to me.’” It should concern everyone. DoubleLine Capital CEO Jeffrey Gundlach recently recommended that Americans invest as much as 25% in gold as a hedge against a weaker Dollar. Ray Dalio agrees – it appears to him (and others) that the Dollar era is nearing an end. (Dalio also is a gold booster, recommending that portfolios include at least 15%.) As the WSJ recently reported, “Investors worried about the future of the Dollar and other major currencies are piling into gold, bitcoin and other alternative assets, powering what has become known on Wall Street as the debasement trade.” That’s precisely right – the Dollar is being debased. Gold, silver and Bitcoin are rising in unison as a response. The world is witnessing de-dollarization, a trend that is accelerating. Unless stopped, its ending will be calamitous.

President Trump believes that the easiest way to lower deficits is by getting the Fed to lower rates and thereby make servicing America’s debt cheaper. He also believes that he is the best judge of Dollar policy-making. Although TLR hopes he is right, the markets today are saying otherwise. America excels in large part because of its “exorbitant privilege,” a privilege that is eroding. Despite Griffin’s, Gundlach’s and Dalio’s enthusiasm for gold as a hedge, today’s story is not about Dollar alternatives. It’s about de-dollarization. President Trump should reconsider what he’s wished for.

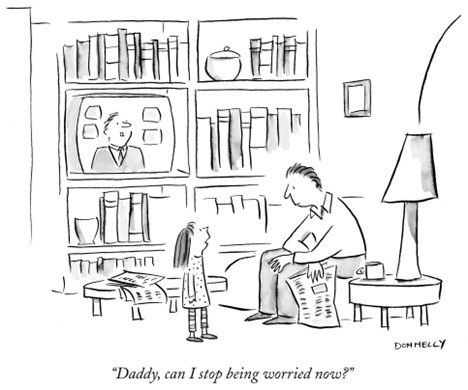

Finally (from a good friend)

No Comments