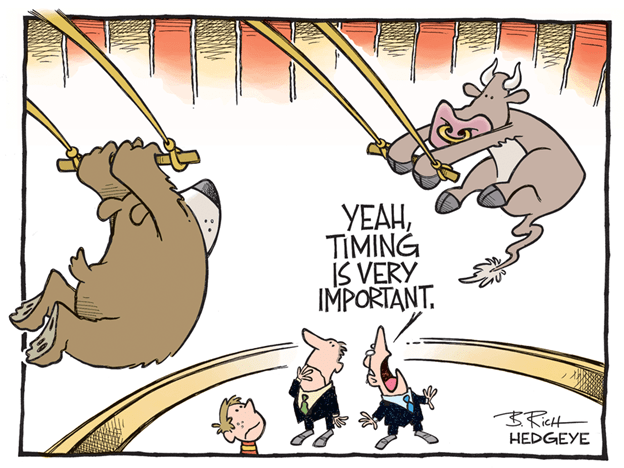

08 Nov Timing is Everything

“That is, investment timing is everything…, except over the past decade and a half when ‘buying the dip’ has been all the ‘timing’ needed.” – The Lonely Realist

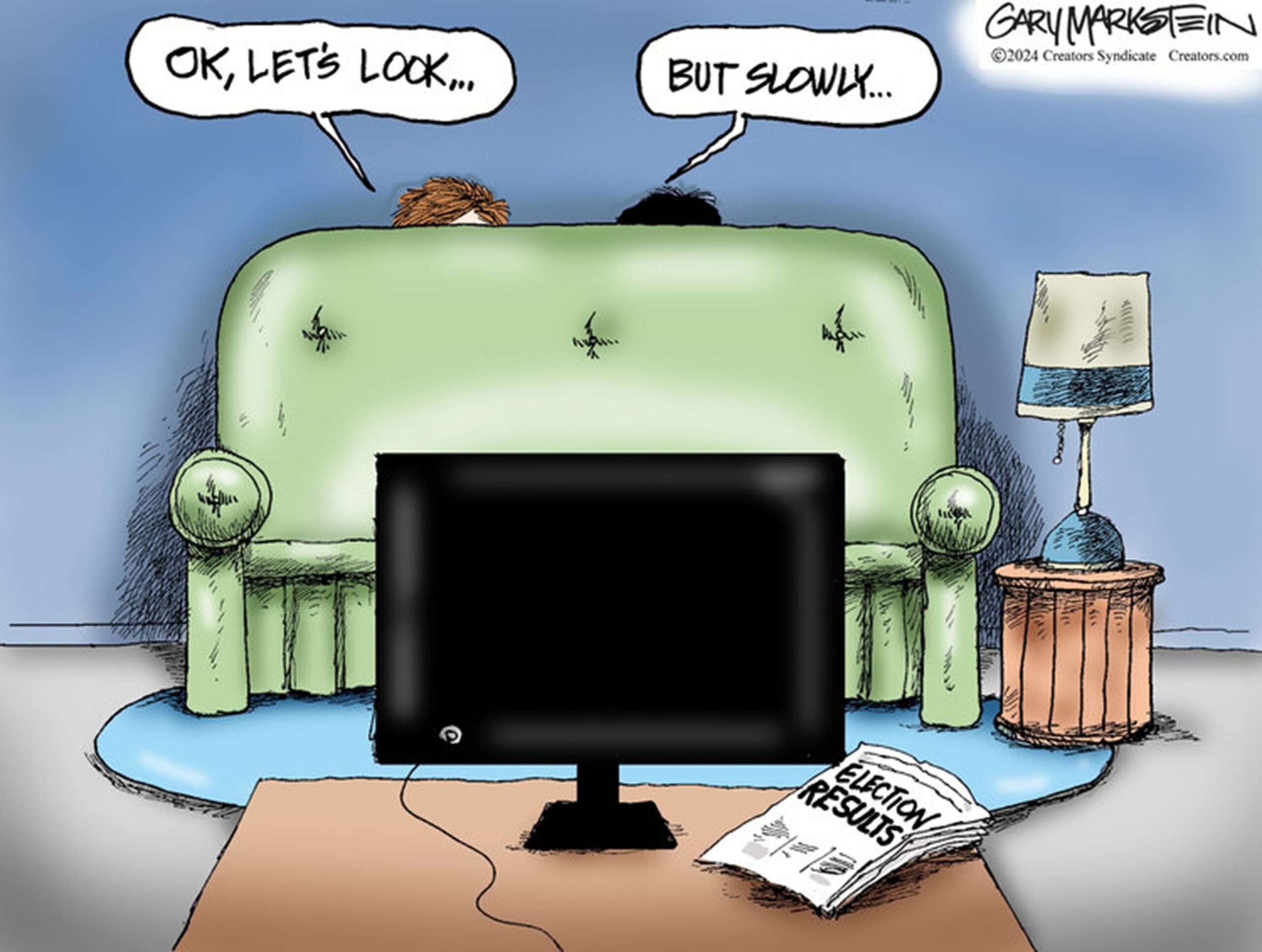

[“Timing is Everything” was written earlier this week, before “the dip.” Did you or will you be buying this dip?]

“Timing isn’t the most important thing. It’s everything” is an age-old adage. It is of particular relevancy in the investing world, a reality that shapes not only individual investment portfolios but entire economic narratives…, which makes timing one of the most debated and consequential aspects of wealth creation and capital preservation. While fundamental analysis, diversification, and risk management form the bedrock of a sound investment strategy, the timing of entrance and exit from an investment historically has meant the difference between profits, losses and, for some, economic survival … except, that is, over the past 15 years when it has been best to simply “buy the dip.”

Market cycles underscore why timing can matter so profoundly has, in the past, been of importance. Markets historically have moved through phases: accumulation; markup; distribution; and markdown. Each phase has offered different opportunities and risks. Investors who recognize transitions have positioned themselves, buying during “accumulation” when prices are depressed and sentiment is pessimistic, adding during “markup” as prices are rising, then selling during “distribution” when euphoria peaks. Missing these transitions has significantly impacted capital retention and financial returns. The current market cycle, however, has been different. It has evidenced a seemingly endless “accumulation” and “markup” period. No prior cycle has lasted this long or seen such a level of market appreciation. Has the economic cycle therefore been repealed? Might this time be different?

Although an aggressive inference, the amount of Dollar-printing – that is, money injected into America’s economy – has been unprecedented, and a massive quantity of those Dollars have flowed into America’s stock market. Moreover, human history has never before seen such immense simultaneous progress in health, life expectancy, lifestyles, social interactions, trade, international relations, etc., or experienced such rapid technological (including artificial intelligence), agricultural, industrial and economic development…, changes that are improving the human condition at a truly revolutionary pace. What effects will each of these have on today’s economic cycle and on stock market prices?

The economic counterpart of physics’ Law of Conservation of Energy is Stein’s Law: “If something cannot go on forever, it will stop.” Does such a “conservation of economic energy” limitation continue to have stock-price efficacy in the 21st Century?

Many believe not. The Federal Reserve, both of America’s political parties and the Federal government apparently are non-believers. Each has been and continues to be an enthusiastic supporter of endlessly printing Dollars to fund America’s perpetual over-spending, one effect of which is to subsidize and energize ever-rising stock prices. They all are apparent subscribers to Modern Monetary Theory, which posits that, because the U.S. government owns the printing press, the U.S. can amass and service virtually unlimited debt by printing Dollars. No matter how much debt the U.S. runs up, and no matter how high a price it has to pay in interest, it can always pay its obligations by printing more Dollars. As a result, the Federal government has been spending profligately, running up an enormous $38 trillion of ever-increasing debt and continuing to print money at a furious rate.

A notable contributor to America’s post-2009 money-printing has been the Federal Reserve, whose mandate is to guard against market volatility and economic instability by operating countercyclically to loosen policy during downturns and tighten policy during expansions. Its countercyclical approach historically relied on interest rate manipulation. When economic activity slowed or unemployment rose, the Fed lowered its benchmark interest rate, making borrowing cheaper. This stimulated spending, investment, and hiring. Following the Great Recession, however, the Fed significantly expanded its toolkit beyond interest rate adjustments by engaging in Quantitative Easing (by purchasing massive quantities of Treasury bonds and mortgage-backed securities) and, in doing so, injected trillions of dollars into the U.S. economy (of which ~$6.5 trillion remains outstanding). These efforts had their desired effect, dampening threatened downdrafts and offsetting the few “markdowns” that occurred following the Great Recession. The Fed’s efforts at smoothing the market cycle have been controversial and have been viewed as experiments in economic mismanagement. The Fed, after all, has altered its role from being a passive liquidity provider to being an active cycle manager. Doing so reflects broad changes in its thinking and in political pressures expectations…, evidenced most recently by the Fed’s announcement that it will be lowering interest rates and ceasing its balance sheet reduction program on December 1st despite the fact that private credit and credit creation remain strong, stocks are at new highs, credit spreads are near their lows, unemployment is near its lows, inflation is above target, and AI stocks are in a bubble. Any subsequent “adding of reserves” will have the effect of monetizing government debt and further lift stock market prices.

The two Political Parties have collaborated to support Federal Reserve efforts. A Republican Senate passed the $900 billion Coronavirus Response and Relief Supplemental Appropriations Act that was signed by President Trump in December 2020, the Biden Administration in 2021 and 2022 enacted the $1.9 trillion American Rescue Plan, the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act, and President Trump this year signed the One Big Beautiful Bill. The cumulative effect of these actions has been to massively stimulate economic activity and super-charge stock market prices.

“May you live in interesting times” is a warning of potential danger and uncertainty. We indeed are living in interesting times. Although 2025 resonates with many of the same issues/tensions/conflicts as past economic cycles…, it is different in the quantity and quality of those issues, tensions and conflicts. America is not at the beginning of a new economic cycle. It is in the latter stages of one…, a tempest of simultaneous multi-year developments in which the evolution of dangers and achievements are impossible to predict. It is at times like this that considerations of investment timing aren’t merely the most important things…, they indeed are everything.

Finally (from a good friend)

No Comments