03 Jan 2026 and The New World Order

“The Trump Revolution continues.” – The Lonely Realist

TLR’s focus throughout 2025 has been on the range of existential problems complex issues facing America. These concerns were challenged by TLR’s imaginary mythical prophetess Cassandra in TLR’s December 6th commentary. She reasoned that Trump 2.0 has been executing a comprehensive plan that will balance inflationary pressures and pro-growth policies with transformational foreign policy, all of which will benefit America. As readers well know, Cassandra’s predictions on these pages have been uncannily accurate. Although she continues to be optimistic, at least in the near term, TLR’s conversation with her this past week revealed a mixed set of predictions for 2026:

On the Domestic Side:

America’s economic statistics will be supported by the President’s appointees at the Bureau of Economic Analysis and Bureau of Labor Statistics. The reported CPI for November showed annual inflation of 2.7%…, which was well below expectations (though consistent with the President’s assertion that “inflation has been defeated”). The Q3 GDP report saw annualized growth of 4.3%…, which was well above the expected 3.2% (the President proclaiming that GDP growth “should be able to be 20% or 25%”). Given the Trump Administration’s self-serving “sources,” neither report should have been a surprise. Expect even better numbers going forward.

America’s stock market will continue trending upwards largely as a result of continuing economic expectations. Wall Streeters as usual are bullish, forecasting that stock market indices will achieve gains of ~9% in 2026. Expect the combined effect of favorable government data, fiscal stimulus, AI productivity expansion and further deregulation to produce an irrationally exuberant market (coupled, however, with increased volatility). The last few months of 2026 will see a reversal.

Spending on AI in 2025 accounted for ~90% of America’s GDP growth. That level of AI contribution in 2026 is unsustainable, requiring an increase in the amount of already exalted AI expectations valuations capital spending. In order for there to be economic growth in 2026, capital necessarily must flow primarily to alternative growth investments. Expect non-AI capital spending to support anemic economic growth. Value investing in 2026 (that is, successfully selecting non-AI winners) will prevail over 2025’s AI momentum investing.

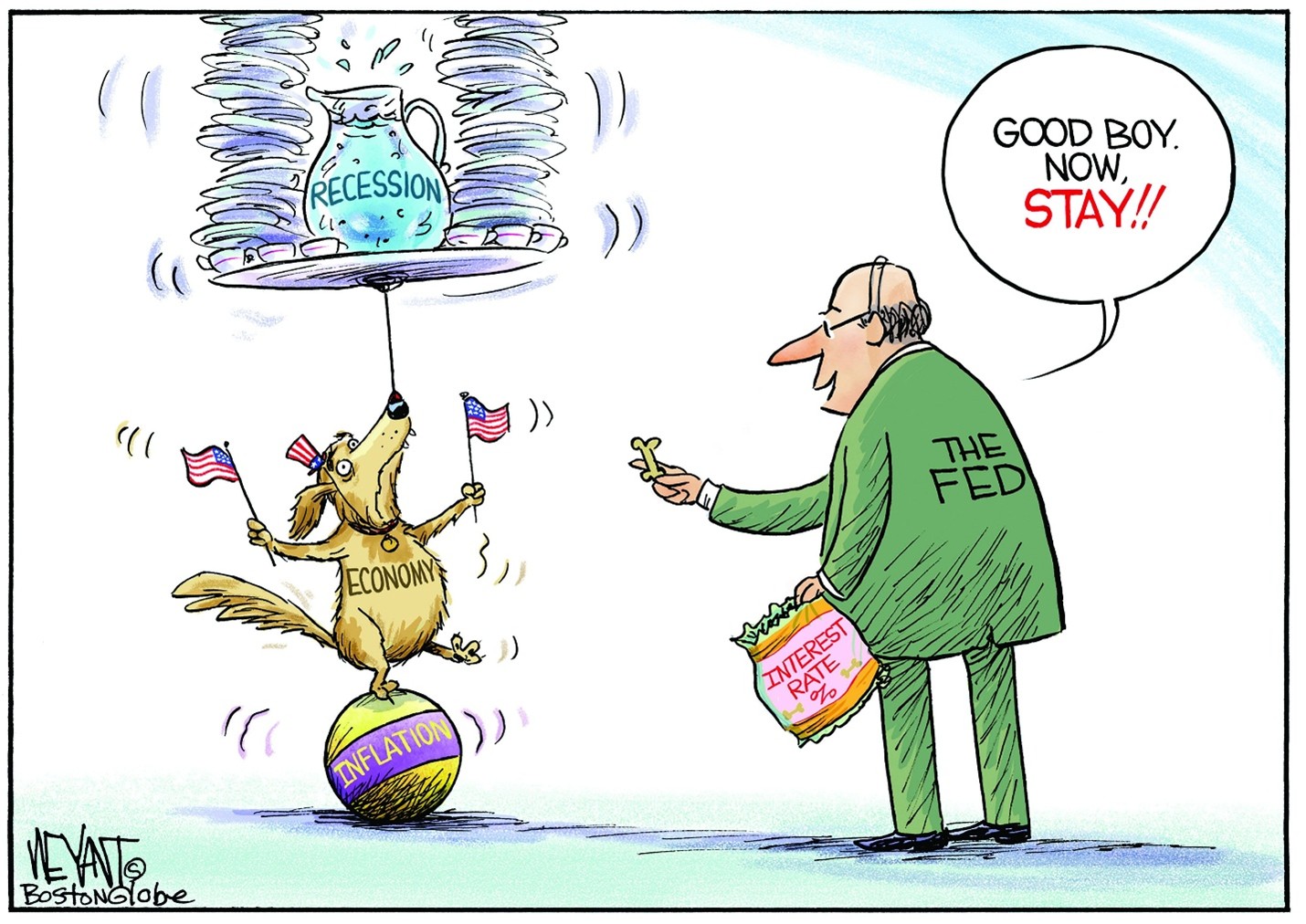

Interest rates will be held in check by a decidedly dovish Federal Reserve. Expect at least 3 cuts in the Fed’s benchmark rate in 2026 together with increased bond buying (Quantitative Easing).

The Federal government has estimated that the One Big Beautiful Bill Act will reduce tax collections by $570 billion. Expect Federal revenues to decline by at least $750 billion, the additional $180+ billion due to proliferating tax shelters and reduced tax enforcement.

The Dollar declined by almost 10% in 2025, with its safe haven status eroding because of the Administration’s America First policies that, among things, expressly target a weaker Dollar. Dollar Debasement will accelerate in 2026. Expect the Dollar to continue its decline and, as a consequence, for gold and silver (silver now another Chinese “rare earth”) prices to appreciate (their value being inversely correlated with the Dollar).

The Midterm Elections will create unprecedented turmoil. [ED NOTE: As TLR previously observed, “The President has taken the steps necessary to ensure a continuing Congressional majority by gerrymandering Congressional seats and selectively outlawing mail-in balloting in order to, in his words, “bring HONESTY to the 2026 Midterm Elections.”] Republican Party goals will be helped by Elon Musk’s financial support and the Supreme Court’s decision in Trump v. Illinois which blocked President Trump’s attempt to deploy the National Guard in Chicago. The President will cite that decision to support application of the Insurrection Act to impose martial law on selected Blue cities and election districts. Expect the Republicans to maintain control of both Houses of Congress in 2026.

On Foreign Affairs:

With Pax Americana at an end, the era of global peace and stability is over.

President Trump will meet with Kim Jung Un, acknowledge North Korea as a nuclear power, and agree to a gradual normalization of diplomatic relations.

Expect President Trump to cram down a peace deal that leaves Ukraine and the EU vulnerable to Russia, increases global supplies of oil and gas (undercutting the green revolution (to the detriment of China), tanking energy prices and reducing global inflationary pressures), and leads to a new global “sphere of influence” order that effectively cedes Eastern Europe to Russia and East Asia to China and asserts American hegemony over the Western Hemisphere. President Trump will host the treaty signing ceremony, attended by Vladimir Putin, Volodymyr Zelenskyy and a few European representatives…, with most European nations believing that the treaty will embolden Russia to take aggressive actions against them.

Taiwan in 2026 will begin a gradual transition that, during this decade, will result in its acceptance of Chinese hegemony.

America in 2026 will not interfere with the development/acquisition of nuclear weapons by other nations (including Japan, South Korea and the EU). America will not intervene in regional conflicts (e.g., India-Pakistan, Thailand-Cambodia, Sudan/Niger/Nigeria, Congo-Rwanda, and Israel-Gaza/UAE/Saudi Arabia) that do not involve anti-American terrorist organizations unless those conflicts directly threaten America’s transactional interests. Expect local conflict levels and nuclear proliferation to increase.

Expect America to escalate its assault on Venezuela’s Maduro regime until it is deposed…, which will occur early in 2026 [ED NOTE: which apparently is what happened shortly before today’s TLR went to press]. Also expect America to increase pressure on Greenland and Denmark, support regimes in Argentina, Ecuador, El Salvador and elsewhere that provide transactional and/or domestic benefits to the Trump Administration, and challenge leaders of those countries that deny American regional sovereignty or threaten its transactional interests (actively supporting opposition parties and candidates in Brazil, Columbia, etc.).

Errata:

Crude oil currently is trading at ~$58/barrel at the same time as an ounce of silver is trading at ~$70. Silver rose ~150% in 2025 while oil declined nearly 20%. The oil-to-silver ratio historically has been ~3.8. It is now at ~0.8. Unless President Trump engineers a favorable peace treaty with Russia, expect crude prices to rocket in 2026.

Expect spreading epidemics in the U.S. in 2026 as vaccine immunity decreases.

Expect Donald Trump’s involvement with Jeffrey Epstein to be leaked: “If Donald Trump can thrive by admitting that he would grab women by the pussy and could ‘stand in the middle of Fifth Avenue and shoot somebody,’ it should be clear that the Epstein files contain shocking information (as Elon Musk already has made clear)…, but their disclosure will have no discernable effect on the Midterms or on President Trump’s exercise of Presidential autonomy.”

Expect a highly functional Rosie the Robot to be a media sensation, although its price will limit 2026 distribution.

Finally (from a good friend)

No Comments