27 Sep A Cassandra Recessflation?

[TLR IS TRAVELING AND ON WEDNESDAY RECEIVED THE FOLLOWING LETTER FROM CASSANDRA:]

“A recession (along with increasing inflation) is fast-approaching.” – Cassandra

Dear Mr. Realist:

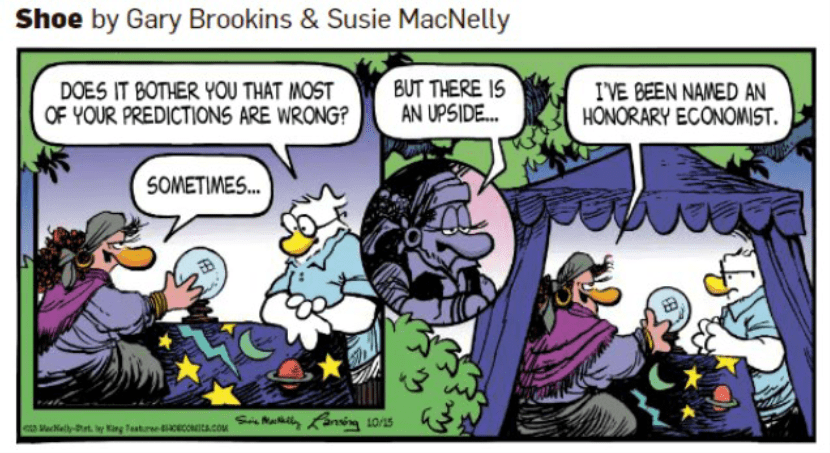

Allow me to return to the conversation you and I shared several months ago. The developing weaknesses in the U.S. economy that I pinpointed last March have only increased, a reality that I further highlighted in my letter that you shared with your readers in May. Those weaknesses are signs of increasing economic turmoil – and a forthcoming recession. This is an outcome that you, Mr. Realist, recently rejected in your upbeat forecast of “Stagflation.” With all due respect Mr. Realist, unlike me, you are no oracle. My prophecies may not be believed, but they have been proven accurate. Yours, not so. After all, you are a mere mortal. And, like so many others, you have allowed yourself to be seduced by pundits touting the predictive value of stock market rallies. Everlasting good times are what the public wants to hear – that America’s economy will continue on an upward trajectory. You, Mr. Realist, should know better. There is no such thing as a benign version of stagflationary stasis. Periods of economic and political turmoil do not end well. Economies do not remain static. While there is good news even in bad times, those who lean on that news to justify bullish excess are delusional…, or are purposely deluding others. Today’s cumulation of bad economic news will continue, ultimately overwhelming the good. An end-of-cycle finale is approaching.

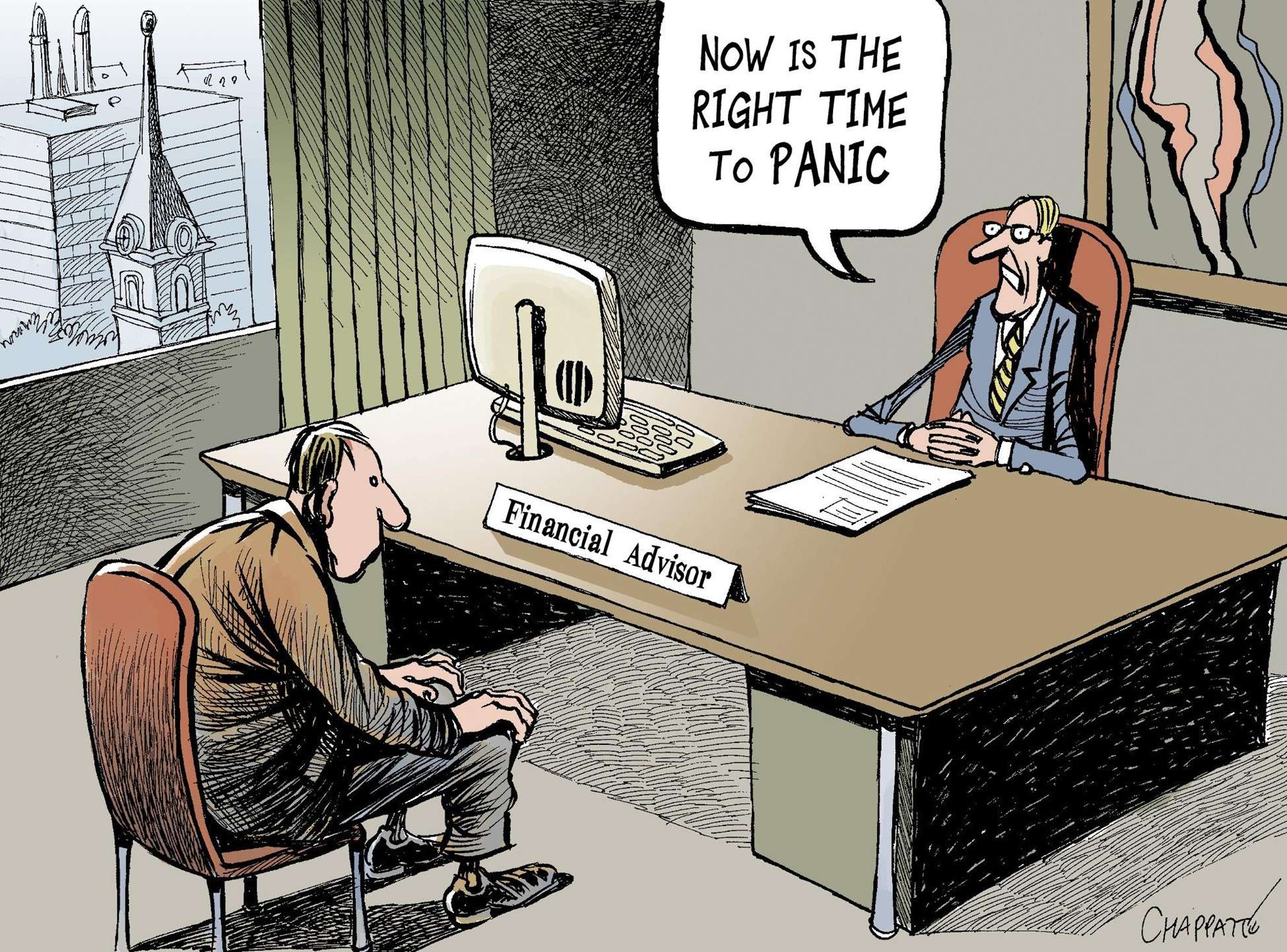

Even so, it’s impossible not to applaud the stock markets’ stellar post-Liberation Day performance. The rally has been impressive, with indices up by >33% since early April, evidence of a boundless belief in America’s economic future. That performance has led so-called momentum investors to conclude that past performance signifies equally stellar future performance, and that increasing corporate profitability will lead to continuing economic expansion and ever higher equity prices. Nothing could be further from reality. Momentum investing is backward-looking. It is an endless projection of misplaced optimism. While everyone certainly hopes that an ever-expanding economy and ever-upward markets are America’s well-deserved destiny, experience (and common sense) argue otherwise. Nothing is forever. Never during my thousands of Gods-given years of mythical experience has that happened. The headwinds simply become too strong. Although the economic alarm bells are ringing louder and louder, too many are deaf to their warnings…, or have simply decided to ignore them. It is worth noting that concerns about the end of the economic cycle are not only being voiced by demented permabears and anti-Trumpers, but also by reputable economists.

While it is true that the Trump Tariffs have had little perceptible impact on either corporate profits or America’s economic growth, that cannot continue. Tariffs are taxes and taxes depress spending and raise consumer prices. The Trump Tariffs already are nibbling at business profitability and, once they bite (which will begin happening in Q4), their impact will demonstrably constrict growth. Corporate profits have been climbing as a result of prudent pre-tariff inventory building. Tariff-initiated price increases only now are starting to impact costs and soon will be impacting on consumer wallets. The economy accordingly is balanced on a stagflationary knife-edge – too little growth will push it into recession and too much will increase inflation. That push-pull is fast-deepening. Faced with Trumpian pressures, the Federal Reserve has begun an easing cycle. Lower interest rates will save jobs, reduce Federal budget deficits, and incentivize investment, but also will be inflationary. It would be excessively optimistic to believe that the adversarial relationship between the Fed and the Trump Administration will be constructive. The Fed is run by technocrats and the Trump Administration by President Trump. Their priorities are different. Moreover, President Trump is determined to take effective control of all aspects of government, further reducing interest rates, weakening the Dollar and replacing the Fed’s process with one-man decision-making. It stretches credulity to believe that the resulting tug-of-war – and the tug-of-war between growth and inflation – will keep America’s economy growing ever-upward. That’s especially challenging in the face of today’s macroeconomic and geopolitical headwinds.

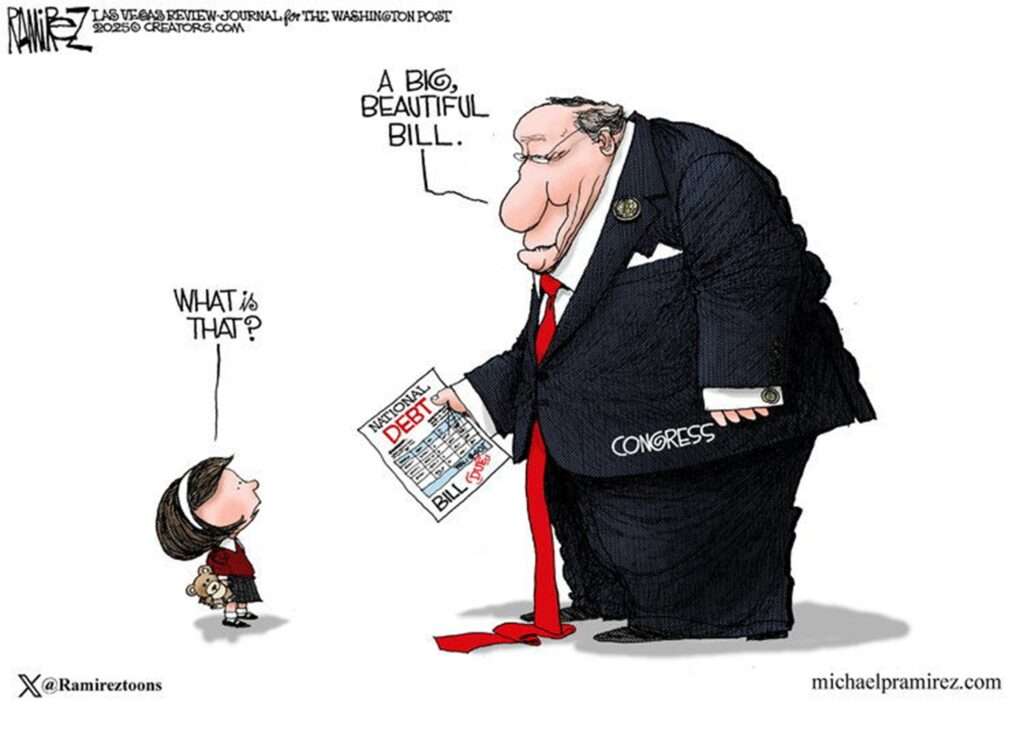

The Trump Tariffs have a dual impact: they decrease corporate profitability and disrupt supply chains. Those Tariffs soon will be confirmed, modified, or struck-down by the Supreme Court, with unpredictable, albeit further disruptive, consequences. Consider the combination of tariff volatility, Federal Reserve conflict, the impact of the OBBB’s tax reductions (that will perpetuate huge deficits, ever-increasing bond sales, and significantly higher debt service payments), economic weakening (e.g., housing starts have fallen to their lowest level since May, consumer credit scores are falling at their fastest rate since the Global Financial Crisis, job creation is slowing at a perilous rate), increased domestic disorder (e.g., the deployment of the National Guard in cities, ICE raids on foreign manufacturers, deportations that flow from a high-pressure anti-immigration policy that recently was extended to skilled workers, the murder of Charlie Kirk, rising gun and political violence), the ongoing Ukraine and Middle East Wars, and external geopolitical events that include maneuverings by China, Russia, North Korea, et al to enlarge a growing anti-American axis (that you, Mr. Realist, refer to as the “Axis of the Sanctioned”). The Trump Administration’s efforts to weaken the Dollar (it is down >10% YTD) and create crypto alternatives are having the undesirable effect of gradually eroding the Dollar’s status as the world’s reserve currency. A consequence of the weakened Dollar is that U.S. Treasuries are losing their exalted “safe haven” status. These and similar consequences will progressively impact the U.S. job market and America’s economy. History shows that these sorts of pressures end badly. That end is approaching at an accelerating pace. The choice between rising inflation and recession is an unpalatable one. However, both are not mere possibilities. They are America’s future.

Finally (from a good friend)

No Comments