21 Jun CRASH!

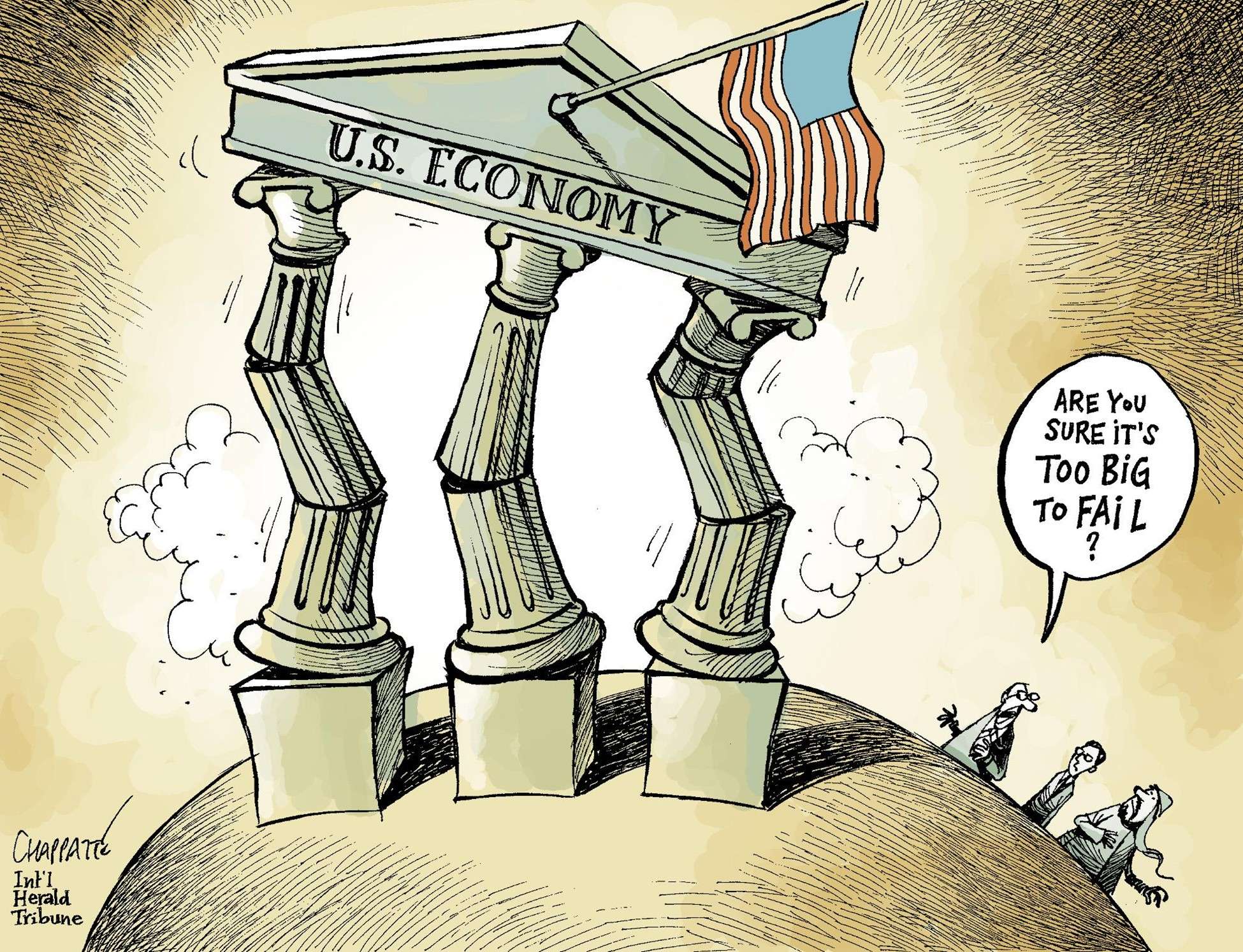

“Is a crash inevitable? Is the only question ‘When?’” – The Lonely Realist

Ray Dalio recently wrote about the difficulties with “The U.S. Government’s Situation”:

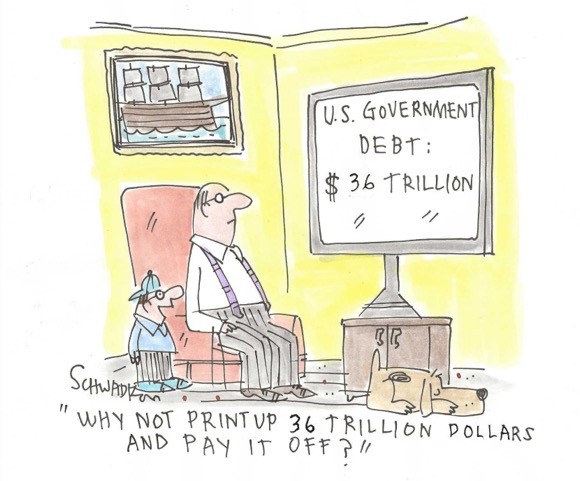

“[I]magine that you are running a big business called the U.S. government…. The [U.S. government’s] total revenue this year will be about $5 trillion while the total expenses will be about $7 trillion, so there will be a budget shortfall of about $2 trillion. So, this year, your organization’s spending will be about 40 percent more than it is taking in. And there is very little ability to cut expenses because almost all the expenses are previously committed to or are essential expenses. Because your organization borrowed a lot over a long time, it has accumulated a big debt—approximately six times the amount that it is bringing in each year (about $30 trillion), which equals about $230,000 per household that you have to take care of. And the interest bill on the debt will be about $1 trillion which is about 20 percent of your enterprise’s revenue and half this year’s budget shortfall (deficit) that you will have to borrow to fund. But that $1 trillion is not all that you have to give your creditors, because in addition to the interest you have to pay on your debt, you have to pay back the principal that is coming due, which is around $9 trillion. You hope that your creditors, or some other rich entities, will either relend or lend it to you or some other rich entities. So, the debt service payments—in other words the paying back of principal and interest that you have to do to not default—is about $10 trillion, which is about 200 percent of the money coming in.”

That is the current situation.

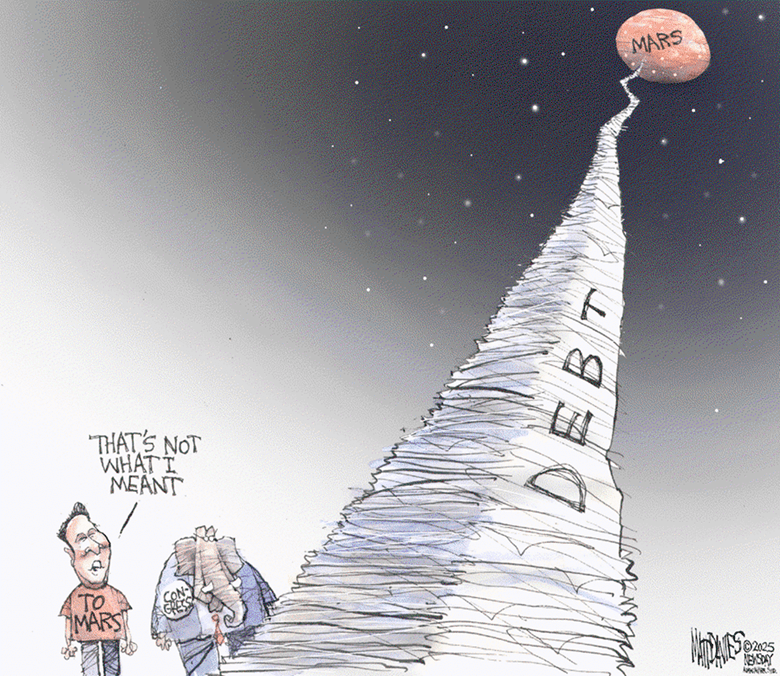

Dalio, and many others, believe that this is untenable: “[T]he government’s financial condition is at an inflection point because, if this is not dealt with now, the debts will [soon] build up to levels where they can’t be managed….” Dalio forecasts that if America does not quickly change its fiscal course, the debt collapse – or CRASH! – “will come in three years, give or take two.” If Dalio is right (and he’s been warning about such a catastrophic outcome for years), America may be facing an unsolvable fiscal reckoning as soon as next year.

Dalio’s proposed solution is straightforward. He advocates simultaneously raising taxes and cutting entitlements to levels that would shrink America’s budget deficit from its current ~7% of GDP to 3% of GDP. Unfortunately, that is the opposite of what Congress plans to do. Riven by partisan strife, driven by a MAGA majority locked into lowering – not raising – taxes (the tax legislation currently being vetted by Congress has been criticized because it would increase both America’s deficit and its debt (such criticism includes objections by prominent members of Congress)), and with Congress focused not on the public interest but on members’ 2026 re-election prospects, America’s sovereign deficits will continue to grow – equaling or exceeding $2 trillion/year – and its sovereign debt will continue to swell. In addition to rejecting tax increases, neither the President nor Congress has any interest in stirring up voter resentment by reducing current entitlements, including “third rail” Social Security and Medicare benefits (despite lengthening lifespans that will increase Social Security and Medicaid liabilities). Dalio’s recipe for addressing a forthcoming fiscal reckoning therefore is uncookable in 2025.

What would it mean for America if its debts continue to rise? This, after all, now appears inevitable. However, we are not in unchartered territory. Countries have been here before.

History teaches that when a nation’s debts become excessive – as they inevitably do if annual deficits and interest obligations continually increase –, inflationary pressures eventually overwhelm prices. The only way the debt expansion can then be brought under control is by Statist action, such as through rationing and wage-and-price controls, which are exceedingly difficult to successfully compose, impose and enforce. Hyperinflation often ensues. In the end, over-indebted nations default on their sovereign debt and, in the modern world, their stock and bond markets CRASH. Post-WWI Germany is a notable example. Germans experienced hyperinflation, depression and default, leading to a populist contest for government supremacy between Fascists and Communists, each arguing in favor of “the common man,” which in the end resulted in the installation of Adolf Hitler as Germany’s Chancellor and the imposition of National Socialism. Zimbabwe and Argentina are more recent examples of the consequences of sovereign defaults. [QUESTION: Might the Fascists and Communists of the 20th Century be the populist MAGA-ists and Progressives of today?]

Because the Dollar is the global reserve currency, and despite the fact that its status and stature are in decline, America’s response to a debt crisis is not likely to bring about a debt default and a depression. To avoid such calamities, the Federal Reserve would engage in fresh rounds of Quantitative Easing. It would print Dollars and ease interest rates (as President Trump has pressed Fed Chairman Powell to do), continuing to do so until Congress acted to significantly (and most painfully) reduce deficits. The Fed’s actions would be inflationary, highly so. Those actions would significantly and adversely impact stock and bond prices. That’s one of the warnings from Ray Dalio. Recognize that his macroeconomic concern is different from the geopolitical “black swan” threats posed by Russia in Ukraine/Europe, China with respect to Taiwan/East Asia (and by Cold War II), the Middle East with respect to Iran, Hamas and the Houthis, North Korea, the tariff war(s), etc. It also differs from the non-macro concerns represented by the leveraged lending of non-bank banks in private credit markets, private equity liquidity risks, crypto/stablecoin perils, the leveraging of crypto, meme stock and options trading (i.e., the gamification of markets), the waterfall effect of potential ETF sales, and other potential “black swan” events cascading through global markets (or only America’s).

Congress today has the opportunity to address and assuage the most material economic risks. American democracy would be best-served if members of Congress worked to that end – that is, working for the public interest rather than for their own pecuniary (and ego-centric) interests.

Finally (from a good friend)

No Comments