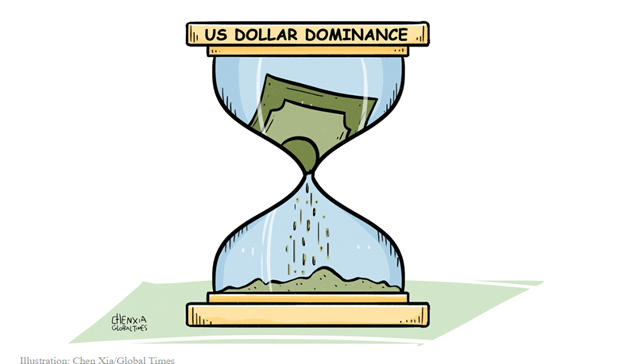

29 Mar Dollar Dominance?

“De-dollarization happens slowly…, then all at once.” – The Lonely Realist

TLR was struck by Cassandra’s observation last week that because Europe now is pursuing an overhauled “Europe First” strategy (notably with respect to defense manufacturing and strategic materials) to compete with Trump 2.0’s “America First,” a consequence will be a stronger Euro at the expense of the Dollar. However, an appreciating Euro won’t be the only consequence of the Trump 2.0 industrial policy. Because the “Europe First/America First” dichotomy favors global onshoring of business and production, it will become the template for other nations that deem Trump 2.0 a threat. After all, a cornerstone of Trump 2.0 is utilizing deglobalization pressure points to weaken the Dollar pursuant to policies articulated by President Trump and Vice President Vance (policies seemingly at odds with views expressed by Treasury Secretary Scott Bessent). President Trump’s faith that a depreciating Dollar will cut the U.S. trade deficit and help U.S. manufacturers and exporters therefore will drive American policy.

As TLR previously highlighted, American sanctions over the last decade+ have driven America’s enemies (the “Axis of the Sanctioned”) towards alternative payment systems. They similarly have motivated BRICS member-nations to seek alternatives to the Dollar in order to escape the potential for becoming targets of America’s proliferating financial and tariff sanctions. In addition to imposing sanctions on Iran, North Korea, Venezuela and others, America cut Russia off from the SWIFT Dollar payments system shortly after Russia invaded Ukraine (discussed here). Because Russia no longer trades with the West, it has been using its oil and gas to barter for goods from China, Iran, Turkey and others and, at times, Russia has accepted the Chinese Yuan as payment. This dovetails with China’s goal of presenting the Yuan as an alternate currency to Dollar hegemony…, noting that the Yuan remains years away from any possibility of being viewed as a Dollar alternative. The intent and the efforts, however, are clear.

There nevertheless is momentum towards de-dollarization, a process that also appears to have years to run. We live in unprecedented times, so predicting how long the Dollar will retain Reserve Currency dominance is speculative. One unfortunate reality is that the Trump 2.0 policy of technological and manufacturing nationalism will face higher costs as nations with resources that are critical for technology and manufacturing choose whether to settle in Dollars or in something else … and at what price. A policy mix of sanctions, aggressive use of the SWIFT system, deglobalization and America First-ism will chip away at Dollar hegemony. If that mix persists, it inevitably will undercut the Dollar (and, as a consequence, reduce foreign investment in the U.S.). Domestic policies are likely to add to Dollar strains. Steps by the Trump Administration that undermine the Rule of Law or the independence of the Federal Reserve could cause serious damage to the Dollar. For example, in February, President Trump signed an executive order stating that “officials who wield vast executive power must be supervised and controlled by the people’s elected president.” An attempt to fire and replace Fed Chairman Powell accordingly could be a trigger point.

What is clear is that at some future date, if current policies and practices continue, there will come a moment when the Dollar’s “exorbitant privilege” evaporates…, bringing to mind Ernest Hemingway’s caution concerning bankruptcy: “How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.” The “privilege” of being the world’s Reserve Currency has enabled America to run sustained balance-of-payment deficits…, which the U.S. has been doing for decades. Because the Dollar is the world’s Reserve Currency, central banks in other countries have been compelled to hold significant quantities of Dollars in order to engage, and enable their countries’ businesses to engage, in international transactions, fueling the international economy and, even more so, America’s own economic health. A strong Dollar means that American consumers enjoy a lower cost for goods that are produced offshore, meaning that goods (absent tariff duties) are cheaper for Americans. It also means that investment in America is more stable and, consequently, more attractive, drawing in global liquidity from all over the world, driving up international demand for American products and thereby enhancing the profitability of U.S. businesses… and, in a virtuous circle, further entrenching the Dollar as the world’s Reserve Currency, creating massive demand for U.S. stocks and bonds and financial assets (including U.S. Treasuries) while also lowering the costs-of-borrowing for the U.S. government and America’s businesses…, precisely what America needs to finance its high consumption…, which further lowers prices and increases productivity…, and increases America’s wealth. In short, having the world’s Reserve Currency is of enormous benefit for both obvious and subtle reasons, each of which builds on and echoes the others.

The rest of the world covets the Dollar’s “exorbitant privilege.” Today, other countries are experiencing an international reset brought about by Trump 2.0 domestic and foreign policy initiatives. It resents America’s sanctions, its foreign policy aggressiveness, the weaponizing of the SWIFT payments system, and tariffs. Foreign national banks unsurprisingly are reducing their Dollar reserves and have been amassing gold in their treasuries… and at an accelerating pace. Although China is the world’s largest gold producer, it has been the #2 annual buyer of gold, with Russia and Turkey holding the #1 and #3 spots. Even though America’s economy has outperformed those of every other developed country over the past several decades, hosts the world’s leading businesses, and is a magnet for entrepreneurs and foreign talent, there is no guarantee that America’s policy mix will continue fertilizing these advantages…, together with the Dollar’s exorbitant privilege. Observing how the rest of the world is reacting to Dollar bullying is instructive. What it means is that today’s trends are not the Dollar’s friends.

Finally (from a good friend)

No Comments