22 Mar Recession?

“Has the Trump Administration engineered a recession?” – The Lonely Realist

President Trump is waging all-out war on the Federal bureaucracy, on America’s trade partners, and on America’s NATO allies. The execution of Trump 2.0 policies has created uncertainties that make business planning hazardous, and America’s economy is feeling the chill…, as are America’s stock markets. Does that portend a recession?

The economic core of Project 2025, the blueprint for Trump 2.0, calls for gradual tariff hikes complemented by a weakening Dollar managed pursuant to a so-called “Mar-a-Lago Accord” that, in substance, would impose a fee on foreign holders of Treasury securities. That isn’t what is happening. There has been nothing “gradual” about President Trump’s first 2 months, with (among many other things) on-again, off-again tariffs, an April 2 universal tariff deadline, and a rapidly deflating Dollar.

TLR highlighted the complex issues facing the incoming Trump Administration in “Everything, Everywhere, All at Once,” a 3-part November series (here, here and here). The economic concerns thereafter were challenged by TLR’s mythical prophetess, Cassandra, who reasoned that Trump 2.0 had a thoughtful plan that would balance inflationary practices with pro-growth policies. As readers well know, Cassandra’s economic and political predictions in these pages have been uncannily accurate. Although she has been refreshingly bullish over the past several years, the actions taken by the Trump Administration have upended virtually everyone’s expectations. TLR therefore thought this an appropriate moment to once again engage with Cassandra:

TL Realist: Good morning, Cassandra. The frantic pace of Trump Administration utterances and actions has caught many by surprise. Readers of TLR are eager to hear your insights.

CASSANDRA: It would be my pleasure, Mr. Realist.

TL Realist: Let’s start with your assessment of America’s economy. President Trump has expressed his belief that tariffs favor America because they will bring manufacturing onshore and increase government revenues. He acknowledged on March 4th, however, that his imposition of tariffs means that “There will be a little disturbance.” What is your take on the level of that disturbance?

CASSANDRA: Although some pundits have predicted that the Trump tariffs will result in rising inflation, higher interest rates and unprecedented economic growth, others have forecast deflation, sinking interest rates and economic depression. The reality is that America will continue experiencing a high level of economic volatility accompanied by economic contraction – stagflation at best. Aside from the potential onshoring of manufacturing and dubiously vetted revenue gains, a principal goal of Trump 2.0’s policy execution is to engineer a recessionary reset to America’s economy. That recession has arrived. Unfortunately, economic pain will last longer than the Administration believes. Don’t look so surprised, Mr. Realist. After all, it is good politics for new Administrations to take harsh economic medicine as quickly as possible. The Trump Administration believes that the consequential economic clouds will clear before the next election. After all, recessions normally last 10 months and are followed by periods of perceptible growth. Unfortunately, this recession will last longer. That is because the Trump Administration’s actions have destabilized America’s economy, its markets and its global relations. And that destabilization cannot easily be undone.

TL Realist (frowning): That’s a dark forecast, Cassandra. Will the Trump 2.0 tariffs indeed cause inflation to increase? Fed Chair Powell apparently has a different perspective but is disinclined to further ease interest rates. The market accordingly is forecasting only two rate cuts this year. Why is that off-base?

CASSANDRA: Tariffs, Mr. Realist, eventually lead to deflation because they depress global economic activity, but they do so only over a period of time. Tariff increases initially are inflationary – that is, they have a transitory price-increase impact. What “transitory” means in each instance, however, differs. The Trump 2.0 tariff announcements have been dizzyingly disruptive and therefore already are having a disproportionate impact. Yet, those tariffs are relatively unimpactful when compared to their promised successors. If President Trump’s April 2nd tariffs are implemented, the inflationary impact will be consequential and will have significant knock-on effects that will require too many businesses to quickly dump excess inventory and increase prices in order to remain profitable. That also will reduce EPS [ED NOTE: earnings per share], further weakening stock prices in what may become a vicious circle. Many of America’s farmers already are finding it challenging to market their goods. Carmakers, vintners, natural gas exporters and others will face similar challenges.

TL Realist: I’m wondering how deep such a recession is likely to be. For example, U.S. corporate bankruptcies reached a 14-year high in 2024…, and things aren’t improving. The Financial Times has listed 17 ongoing economic negatives that include increased delinquencies on credit card balances, decreased household spending, declining consumer confidence, reduced consumption, reduced manufacturing construction, and reduced small business hiring plans, with falling tax revenues and an increasing Federal deficit. If America already is in recession, as you indicate, where do we go from here?

CASSANDRA: Your Secretary of the Treasury, Scott Bessent, has promised additional “sweeping tariffs” as well as an active “shift away from strong dollar policy.” These will exacerbate the recession. Moreover, America’s abandonment of NATO commitments means that Europe will be spending more on defense and its spending will come at the expense of U.S. manufacturers. “Europe First” will strive to counterbalance “America First” (which will result in strengthening the Euro and weakening the Dollar in unanticipated ways – European stocks already are outperforming American ones). Stock markets have yet to accurately reflect these global realities. How “transitory” the recession turns out to be therefore will depend on factors that even I, with my Gods-given predictive powers, cannot foresee. Mr. Trump is the most unpredictable of leaders. What I can tell you is that the forces that have been set in motion, causing what you recently termed “the breaking of glass” – whether via the deconstruction of America’s Federal agencies, the politicization of its government, the abandonment of Western alliances, the imposition of sweeping tariffs, or by a combination of these and other policies –, cannot easily or quickly be repaired or reversed.

TL Realist: That’s an awful lot to digest, Cassandra. I and my readers thank you for your time and insights.

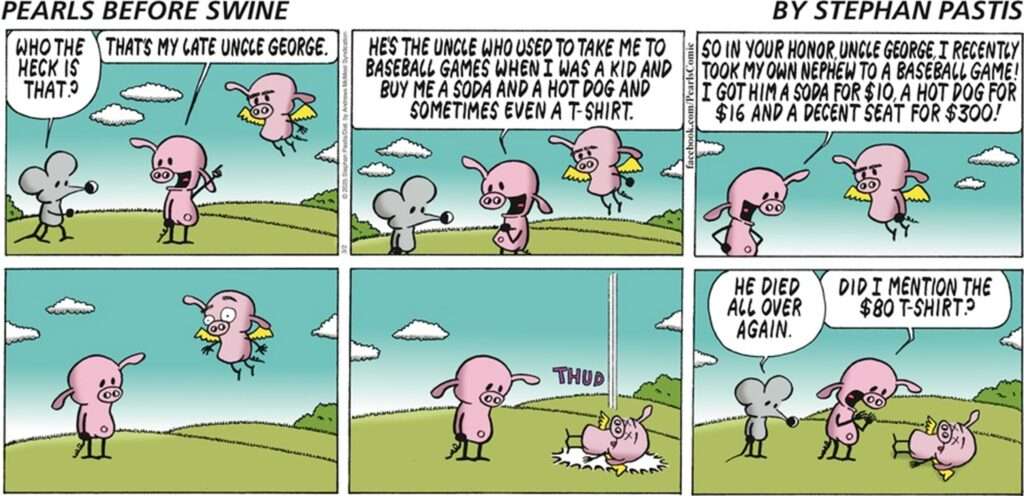

Finally (from a good friend)

No Comments