29 May A Delicate Balancing Act; More Turkey Anyone?*

A Delicate Balancing Act

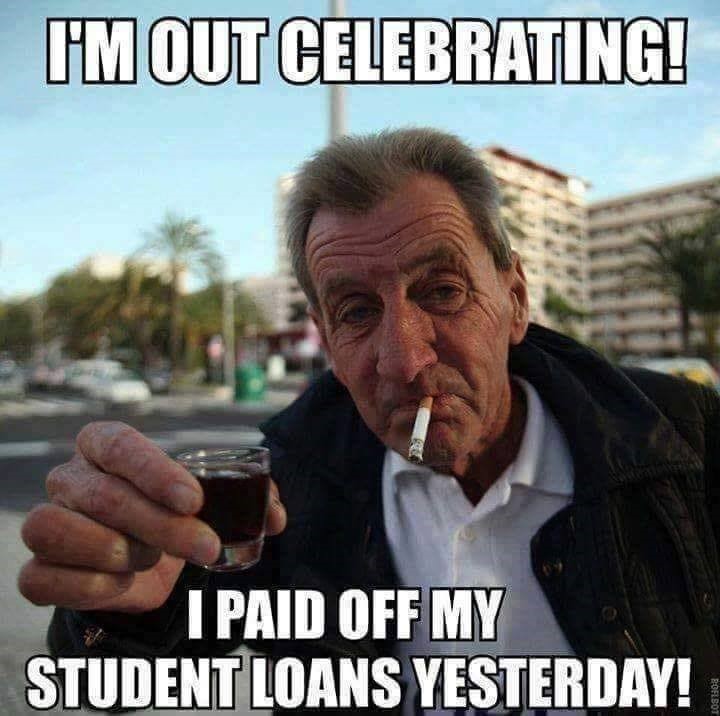

The NY Times on May 21st published an editorial entitled “Charity Won’t Solve Student Debt” the title of which spotlighted the student loan debt debacle crisis. Total student loan debt now stands at $1.56 trillion with more than 44 million Americans on the hook. For many, paying off that debt will be a weight that takes decades to lift … if they are able to lift it at all. For some, the debt will be impossible to repay. Those unable to repay their student debt will become second-class citizens. They and very possibly their children will be unable to participate in the American Dream. Although debtors who find it impossible to repay their debts can file suit in bankruptcy court in an effort to have the debt discharged in bankruptcy, Congress has set a far-too-high bar for students burdened by debt: the debtor must prove that, first, he or she has extenuating circumstances that create a hardship, second, those circumstances are likely to continue for the term of the loan and, third, the debtor has made good faith attempts to repay the loan.

However, the Times’ editorial was not about the student loan debt crisis. Instead, the editorial’s focus was about taxing the wealthy. It made that point in vilifying philanthropically-minded entrepreneurs for not paying more in taxes … and, jarringly, used as its arch-type Robert Smith, who had announced during his commencement address at Morehouse College that he would repay all of the student loans burdening the 396 men in the 2019 graduating class, a charitable act viewed by others as incredibly magnanimous. The Times’ editorial argued otherwise. Although it mentioned similar philanthropic educational grants by other billionaires, including the $1.8 billion donated to Johns Hopkins by Michael Bloomberg, its point was that “[a] new generation of plutocrats has amassed great fortunes, in part because the federal government has minimized the burden of taxation.” Ya gotta love the use of the term “plutocrats.” The Times’ editorial argued for a government-controlled, centralized decision-making process for determining how and to whom such magnanimity should be allocated, and that the money to do so should come from increased taxes on tycoons billionaires plutocrats. Put another way, the editorialist believes that the Federal government is more capable of selecting among needy causes than are individuals. As an example of its view of a more effective template, it cited Andrew Carnegie’s national library construction program, stating that “[t]he United States could have built a lot more libraries by taxing the income of Carnegie and his fellow Gilded Age plutocrats.”

Really?

Even were that so, would the United States actually have built those libraries that became a driver of American educational achievement in the 20th Century? Or would the monies that otherwise might have been collected in taxes have been allocated to pork barrel less beneficial causes? Who is best-positioned to make those determinations, individuals or the State?

Intrinsic to the mechanism of democracy is for charitable decision-making to be left to the people … precisely because centralized micro-management of the economy doesn’t work. It provides the wrong incentives and all-too-often results in corruption misallocations. A prime example of why pluralism is superior to centralized government control is the charitable contribution deduction embedded in U.S. tax law since 1917. It’s been spectacularly effective in funneling monies to where they’re most needed. In addition, without getting into a wooly tax and economic policy analysis, studies have concluded that the tax deductibility of charitable contributions increases gifts to charity by more than it decreases tax collections – that is, the Federal tax deduction for charitable contributions is tax-efficient, saving rather than spending government money. Moreover, since government priorities are established by a majority that may be intolerant of minority goals, gifts to charity also encourage pluralism.

The Times in its editorial conclusion had a second axe to grind and, to do so, returned to Robert Smith: “Smith co-founded the private equity firm Vista Equity Partners, which invests in software companies, and he has amassed his fortune thanks in part to a provision of federal tax law known as the ÔÇÿcarried interest loophole.’ … Closing that loophole would be a much better graduation present for the class of 2019 [than Smith’s payment of their student loan debts].”

Once again avoiding a deep dive into the Internal Revenue Code, the preferential tax treatment of carried interest profits, although labeled a “loophole” by the Times, actually is part of a cohesive, internally-consistent tax policy, one found in many places in the tax law. Eliminating that “loophole” not only would create inconsistencies in tax treatment, but also would have a domino effect that would ripple through the economy, creating new incentives and disincentives – what often is referred to as the law of unintended consequences. The Internal Revenue Code is complicated enough without patching perceived populist Band-Aids over provisions that to some appear inequitable. The better approach – by far – would be comprehensive tax reform that is internally consistent, democratic/pluralistic, economically sound … and simple. (See, for example, “Are our Tax Laws Overly Complex?” in the March 1st TLR.) That, unfortunately, is impossible is today’s over-heated political climate. Attacking Robert Smith and his economically sound and successful business because of his philanthropy seems horribly misguided.

Insofar as the “carried interest loophole” is concerned, President Trump told Fox News earlier this month that he would like to fulfill his campaign promise of eliminating carried interest treatment (stating that those “hedge fund guys are getting away with murder”), but Treasury Secretary Mnuchin put an end to that hope a few days later saying “we’re not doing anything [about carried interest in 2019].” Populism seems the flavor of the moment on both sides of the aisle. Although Congress has considered various “fixes” to the student debt problem, the simplest approach would be to amend the Bankruptcy Law to provide students with the treatment afforded to other citizens … and which existed before the Bankruptcy Law was made more restrictive to favor banks disfavor students in 1998.

More Turkey Anyone?

Turkey is an important member of NATO not only because it is a Muslim country, but also because of its geographical location – it straddles Europe and Asia and controls entry to Russian and Ukrainian ports on the Black Sea, borders Syria, and is an important pivot point in a volatile region. Despite its long-term membership in NATO and 90-year history of secular government, Turkey recently has had a rocky relationship with its European neighbors … partially because the EU has refused to consider Turkish membership, partially because of its failure to prevent a flow refugees into Europe from Syria and the Middle East, and partially because of its slide into totalitarianism. Integral to its strategy to keep Turkey in the Western fold, the U.S. agreed several years ago to allow Lockheed Martin to sell Turkey more than 100 of America’s most advanced Fighter aircraft, the F-35. That was before Turkey began moving away from the orbit of America/NATO and before Recep Tayyip Erdogan became Turkey’s “caliph in waiting.” Things, as they say, have changed.

Russia has been working overtime to neutralize Turkey’s relationship with the West. That effort has met with a good deal of success. Turkey recently agreed to purchase from Russia its most advanced surface-to-air missile, the S-400, the weapon that Russia would use against America’s F-35 Fighter force. Should the U.S. permit Turkey to acquire the F-35 when its relationship with Russia is blossoming, the technology of the F-35 could then be passed along to America’s enemies S-400 could then be refined to defeat tested against the F-35 … which is not an acceptable outcome for America. The U.S. therefore has threatened Turkey with sanctions should it purchase such advanced Russian military weaponry (especially since America already has levied sanctions against Russia) and cancelation of the F-35 agreement – ceasing reciprocal manufacturing and delivery of spare parts in April – and, as a carrot, offered Turkey America’s best surface-to-air missile system, the Patriot, at a discount. Turkey has been given the choice of continuing its alliance with America or siding with Russia as well as, perhaps, Russia’s fellow travelers, China, Iran, Venezuela, Cuba and North Korea. Thus far, Turkey’s authoritarian ruler, Recep Tayyip Erdogan, has stood solidly against America’s entreaties with Russia’s S-400 system. As a further inducement, Russia recently offered him its new Su-57 Fighter Jet. Erdogan now has one week left in which to make a final decision.

Should Erdogan decide to align with Russian armaments, that would take Turkey outside the Western orbit. Turkey would be switching sides. Both the U.S. and NATO would be the weaker for it. So would Turkey. Its expulsion from the F-35 program and the levying of economic sanctions against it would cause Turkey serious economic damage. Turkey already has been in recession and the threat of sanctions has caused the Turkish Lira to take a further dive. And yet this appears to be the course Erdogan has decided to take.

Finally (from a good friend)

*┬® Copyright 2019 by William Natbony. All rights reserved.

No Comments