20 Sep An Interview with Cassandra

You may have read about Cassandra – the young (and, I should add, quite beautiful) priestess who the Greek god Apollo granted the power to accurately prophesize the future …, and then cursed so that her prophesies would not be believed. TLR spoke with her earlier today about the stock market, an abiding interest for most Americans. The question we addressed was whether the market will continue its seemingly inexorable rise, or whether it might instead be headed for a fall. As you will read, although Cassandra’s prophecies are plausible enough, I felt myself rejecting them out-of-hand. You be the judge.

TL Realist: Good morning, Cassandra. Thank you for taking the time to speak with me. Your foresight is legendary … and, as you know, Americans are eager to hear your predictions.

Cassandra: Thank you, Mr. Realist. It’s a pleasure to meet you, if only virtually.

TL Realist: May I first ask how you came to take an interest in the stock market?

Cassandra: Predicting the future requires an understanding of human psychology, of economics, and of nature, as well as having access to the insights of the Gods. I work hard at it. It takes up all of my time, and I find the subjects intensely interesting. It’s who I am.

TL Realist: To give credit where credit is due, you are justifiably renowned for doing so. So, to business. We are at a point, Cassandra, where stocks in the U.S. are up nicely on the year, having risen significantly since they reached a Covid-19 bottom on March 23rd. Do you see that uptrend continuing?

Cassandra: Your facts are not correct, Mr. Realist. More than 60% of the stocks in the S&P 500 Index are down on the year. The fire that lit up the market in late March was from the heat generated by a small handful of stocks. That stock advance was a relatively narrow one … and it ended on September 1st.

TL Realist: Is that truly the case, Cassandra? If so, which stocks are you referring to?

Cassandra: The technology stocks have led the stock advance, Mr. Realist, many of which have benefited from the pandemic. They include Apple, Netflix, Google, Microsoft, Facebook, Amazon, Nvidia, Tesla and Zoom. At its YTD high on September 1st, Apple, for example, had a value of ~$2.3 trillion, which was more than all 2000 equities in the Russell 2000 …, and also more than the value of the FTSE 100, an index that includes the 100 largest corporations in Great Britain. Even today, Apple is up ~50% YTD. Even though all of these top performers have skidded over the last 2-1/2 weeks, Nvidia remains up by more than 100%, Netflix and Amazon by ~50%, Facebook and Microsoft by more than 20%, and Zoom and Tesla by more than 500% (Tesla is now worth more than the combined values of Toyota, Volkswagen, GM, Daimler, BMW, Ford, Fiat-Chrysler, Honda and Nissan). It is these tech stocks that have propelled the S&P 500 index to its current gain of almost 2% for the year and the NASDAQ to a gain of over 10%. The substantial majority of other stocks have performed quite poorly in 2020.

TL Realist: Does this mean that the stock market is weaker than the indices would indicate, or does it mean instead that the economy isn’t as strong as people believe?

Cassandra: What it means is that both the markets and the economy have gotten ahead of themselves.

TL Realist: I’m not sure I understand. The government has reported that U.S. economic fundamentals are exceptionally strong. On Friday, for example, consumer sentiment reached a six-month high. With Covid-19 now largely under control, there is no reason not to expect improving GDP growth which, in the third quarter, is expected to exceed 30%. That’s a remarkable percentage reflecting a remarkable recovery! It should be exceptionally bullish for stocks! Coming on the heels of 10 consecutive years of economic expansion following the Great Recession of 2008-09, such a strong third quarter bodes well for a V-shaped recovery. Wouldn’t you agree with that assessment, Cassandra? If not, what are you seeing in the stock markets that others apparently are missing?

Cassandra: The fact is, Mr. Realist, that the economic indicators that analysts purport to rely on are guesses. They do not reflect the realities. The economic fallout form Covid-19 is not being accurately measured. Nothing is as it appears and projections consequently have become curiouser and curiouser. That is precisely what others are missing.

The Financial Crisis of 2008-09 was never put behind us …, and its pernicious effects are ongoing. Both the Fed and America’s government continue to work to offset those effects …, which have been multiplied by Covid-19. Addressing the fallout from the Great Recession has required the Fed to utilize unique and extraordinary financial engineering tools, and to use them in ways and on a scale that the world never before imagined. The U.S. government and the Fed, as well as central banks and governments the world over, injected massive quantities of fiat money into their economies from 2009-2019 …, and in doing so created massive dislocations and fiscal deficits while achieving merely lackluster growth. Their monetary-manipulative tools have been used over and over again: quantitative easing; open market operations; and lower-for-longer interest rates. Governments have borrowed-and-spent to such an extent that their debts can never be repaid. One consequence, announced by the Fed earlier this month, is to anticipate a markedly increased inflation rate. Because both government and corporate debt is so massive, central banks have decided to inflate away those debts.

When Covid-19 hit, the U.S. accelerated its printing of “helicopter money.” The goal was for that money to be used to rebuild what the combination of Covid-19 and economic closure had destroyed. That has not happened. Money that has poured from the government’s printing presses has not been invested in infrastructure or production or bricks or mortar. Much has been consumed, providing a temporary boost to the economy. Much also has gone into the black hole of failing businesses, whether in leisure or entertainment or food services or transportation or retail or etc. Instead of allowing zombie businesses to fail, instead of allowing the process of creative destruction to follow its natural course and, in the process, invigorate the economy and free up capital and labor for productive purposes, that money has been frittered away. Zombie businesses that were not allowed to fail months ago will more slowly strangle while the economy struggles to grow. They will be fading away at the worst possible time … after they have consumed valuable capital that more constructively should have been allocated elsewhere. The ongoing existence of zombie businesses, their mere presence in the marketplace, also is distorting the supply of goods and the provision of services. Their presence is negatively affecting prices. In order to foster a strong economy, survivor businesses must themselves be strong. The government’s largesse earlier this year, $3 trillion from the U.S. government in the CARES Act and >$3 trillion from the Fed, will have offset only a portion of the survivors’ economic losses. Unfortunately, the effect of the monies injected into the economy has not been to ensure that surviving businesses become stronger and pass along their successes to well-compensated employees. Instead, it has been an economic sugar rush for the U.S. economy, temporarily boosting spending, consumption and asset prices. Most of its impact has dissipated. Unless Congress and the Administration can agree on a well-targeted follow-on injection of needed cash, the gains the economy has experienced to-date will evaporate … and adversely affect the value of stocks.

TL Realist: So, put another way, Cassandra, you believe that stocks are over-priced.

Cassandra: Yes, they are, Mr. Realist.

TL Realist: And yet their prices have continued to rise. How do you explain that, Cassandra? And, if you are right, what does that portend for the stock market over the next several months?

Cassandra: There is an awful lot going on these days, Mr. Realist. The money-faucet of Federal largesse that poured-out to Americans under the CARES Act has run dry. That realization started dawning on the markets at the beginning of September, in many ways reminding me of the pattern from late August-October 1987 … preceding the stock market crash on October 19th. The reduced money-printing is only now beginning to impact on consumption and drain the last drops from State and local coffers. Despite the hype, the economic fallout from Covid-19 is not under control. Moreover, in addition to the possibility that Covid-19 cases will increase as the weather drives people indoors, there is always the question of what impact the flu season will have. The fact that civil unrest in the U.S. is increasing similarly should not be minimized. That unrest will not end on Election Day … no matter which candidate is elected. America is a bifurcated nation, one at war with itself, an additional reality that can only damage its economy and reduce its productivity … as well as the value of its equities. These social, political and economic realities became apparent to market-watchers earlier this month when new Federal subsidies failed to pass Congress. They converged when stock market indices were up more than 60% from their March 23rd lows, an astounding gain in less than 6 months. Those are the ingredients that Covid-19 and the Great Recession have brewed …, and that are now combusting.

TL Realist: Much as I disagree with your analysis, I understand the potentially-explosive nature of the current economic, political and social realities. What I don’t understand, however, is how they can significantly impact on stock prices without some Black Swan spark. The fact is that the U.S. economy is expanding, not contracting, and at an incredibly bullish pace. Vaccines for Covid-19 are imminent and treatments are improving almost on a daily basis. Civil unrest in America has never gone beyond demonstrations and there is no reason to believe that this time will be different. Presidential elections occur every 4 years … and markets shrug them off every 4 years. I’m therefore at a loss to understand what event could blow-up the stock market.

Cassandra: We are living in a truly unprecedented time, Mr. Realist, one of pandemic coupled with extra-ordinary economic policies and international central bank coordination that conflicts with fraught international trade amid rising hegemonic tensions and battles. Confusing, no? There has been nothing like this in the 5,000 years of human history. Together, those are the ingredients for a spontaneous combustion. October is almost upon us … and September-October historically have reflected harsh stock market reactions. They once again are heralding a tumultuous stock market … much like those experienced in previously-memorable Septembers-Octobers. These are months in which bubbles burst. I am well-aware of the universal criticism bearish predictions like these elicit …, especially when those predictions come from me. But the imbalances that exist are so very clear that it is impossible to dismiss them. There are readily apparent uncertainties and excesses …, uncertainties about the trajectory of Covid-19, of global economic and political turmoil, of influenza, of the Presidential and Congressional elections, and of natural disasters caused by fires, hurricanes, and earthquakes …, and of the excesses of overbought, unbalanced stock markets, of worsening corporate profits, and of frothy valuations.

TL Realist (smiling): You most certainly stay in character, Cassandra, and of course, what you are saying doesn’t come as a surprise. You are, after all, Cassandra. However, the markets sold off both earlier this year and earlier this month – correcting significantly each time. Tech stocks have recently corrected by ~13%. That’s not a sign of an excessively-inflated bubble. The fact is that we have an under-inflated bubble. Wall Street firms recently reiterated their bullish forecasts. Goldman Sachs, for example, repeated its prediction that the S&P 500 index will rise to 3600 by year-end driven by improving earnings and a decline in risk premia. UBS has expressed the same view, adding that the Fed’s inflation target overhaul – by encouraging a lengthy period of excess inflation – means that newly-printed money will continue to pour into the U.S. economy. That rising tide of paper money will provide a tail-wave for prices. The Fed’s major policy change brings to mind a longstanding Wall Street adage: Don’t Fight the Fed! Because the Fed wants inflation, it will get inflation. It will print as much money as it needs to do so. That means that there will be more money to chase stock prices … which will drive prices higher. Tell me, Cassandra, why doesn’t that alone mean that higher stock prices lie ahead? And that the two stock market corrections of 2020 – in March and September – have done what corrections normally do, which is eliminate excesses?

Cassandra: Markets of necessity have two sides, Mr. Realist, the buyers and the sellers. You have expressed the view of the buyers. I have expressed the view of the sellers. I must remind you, however, that I have the ability to accurately predict the future. I don’t believe you have that gift.

TL Realist (laughing): You of course have heard the expression, “Don’t be a Cassandra”? It refers to those who consistently predict negative outcomes. You’re taking a terribly dim view of the stock market’s future, Cassandra. Isn’t that simply your way? Aren’t you seeing the worst possible future?

Cassandra: On the contrary, Mr. Realist. I see a very bright future for the stock market. The U.S. government’s fiscal spending and the Federal Reserve’s money-printing are injecting massive amounts of liquidity into the U.S. economy. They will continue to do so, though not sufficiently in the short-term to offset negative economic, political and social realities. Much of the money they print will find its way into the stock market. As a result, the value of equities will increase, in many cases exponentially, helped along, by the way, by a depreciating US Dollar. I’m a full-throated stock market bull, Mr. Realist. However, we are talking today, September 20th … with the sugar high of the CARES Act having expired and with October just around the corner. Now is the optimal time for the stock market to take a breath, a very deep breath.

TL Realist (nodding): Thank you for clarifying that point, Cassandra. And thank you again for your time and your prophecies. One final question, if I may. I’ve read a great deal of Greek mythology. It reports that you were murdered, put to death by Clytemnestra and Aegisthus … and then sent to the Elysian Fields. But you’re here now. How is that possible?

Cassandra: As you should know, Mr. Realist, you can’t believe everything you read.

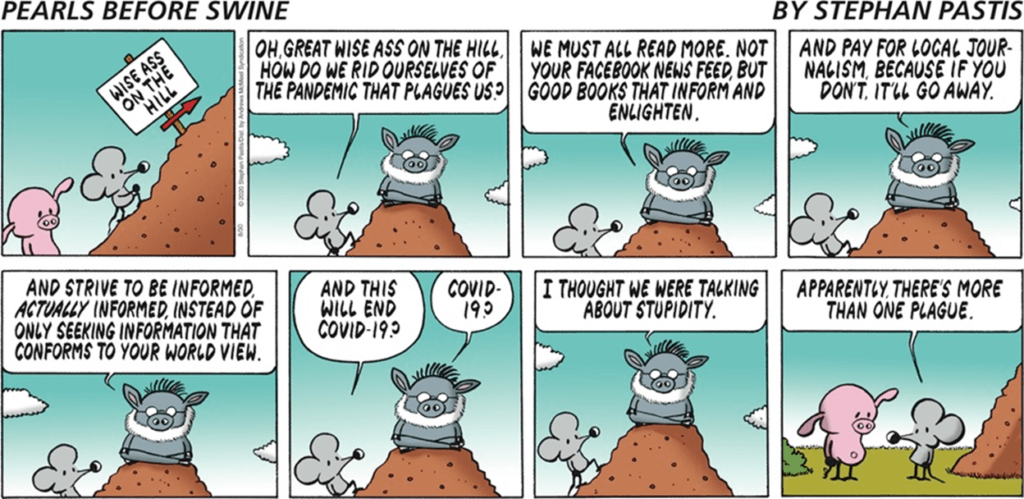

Finally (from a good friend)

No Comments