17 May Notes on 2017 Tax Reform; Saving Face*

Notes on 2017 Tax Reform

The Tax Cuts and Jobs Act of 2017 (TCJA) was a complicated piece of legislation that added a host of new tax provisions to an already overly-complex Internal Revenue Code. Because of the turbo-charged speed of its enactment, it did not go through the normal process of tax committee and staff analysis before being brought to a party-line vote in the House and Senate. It similarly did not have the level of study from the Treasury Department, academics and private industry that tax legislation historically has received. That process was skipped truncated curtailed condensed in 2017. As a consequence, there are any number of necessary and desirable amendments, clarifications, corrections and additions that require action.

In January 2019, 13 months after enactment of TCJA, the outgoing Republican Chairman of the House Ways and Means Committee, Kevin Brady, released a 91-page discussion draft of a proposed Technical Corrections Act. (Not every provision of the proposed Act was supported by his Republican colleagues in the Senate. Had there been a reconciliation of those provisions at the end of 2018 when Republicans were in control of both houses of Congress, the Republican Congress could have enacted any Technical Corrections Act it chose, a baffling omission for a political party that in November had learned that it would lose control of the Congressional agenda in January.) With Democrats currently in control of the House, there is little likelihood of prompt action on technical corrections. Democrats’ priorities, as well as their perspective on how the TCJA should be corrected and clarified, are not the same as those of Republicans. Among other things, Democrats who were excluded from the process of drafting the TCJA are in no hurry to correct Republican errors, especially without adding changes that would be unacceptable to Republicans in the Senate. They would rather delay so that Republicans can be blamed in the next election for the problems they created. There accordingly is some question whether any of the necessary or appropriate clarifications, corrections or changes to the TCJA will be brought to a vote in Congress during 2019 or even 2020. That multiplies already-significant problems. 2018 tax returns were filed based on legislation that in some respects is flawed and requires retroactive correction. Affected businesses and taxpayers are left to determine how best to report their 2018 taxes and plan ahead when they not only can’t project their future tax liability, but may be forced to amend their 2018 tax returns based on retroactive tax changes. (What seems clear, however, is that taxpayers will take aggressive tax positions with little risk of audit and with the certainty that even alleged underpayments will be compromised … creating a concomitant loss of national revenue.) There also are a number of tax breaks that expired at the end of 2017 and were excluded from the TCJA. If Congress subsequently enacts extensions to those expired tax breaks, taxpayers may or may not have made the business decisions those extenders were intended to incentivize. In short, the tax legislative process is a continuing mess because tax reform and revenue collection are irrelevant unimportant secondary to the goals pursued by elected officials. They serve as re-election slogans, not as legislative priorities.

Importantly, tax accountants consider certain important portions of the TCJA to be nightmarish both from a technical perspective and in their interactions with existing Internal Revenue Code provisions. In adding pioneering Code sections at the very end of 2017, Congress placed the burden on the Treasury Department and IRS to draft regulations, instructions and forms provide guidance that would enable taxpayers at the start of 2018 to understand and take advantage of the new laws. That proved impossible both as a timing matter – the effective date of the December 2017 TCJA was January 1, 2018 – and because of the politically-driven consistent underfunding by Congress of the Treasury and IRS. The result is a huge backlog and ongoing uncertainty. (See “The Irritating IRS” in the May 3rd TLR.) The resolution of how America’s tax laws ought to work will require bipartisanship. Beginning with relatively straightforward technical tax corrections might provide a useful vehicle for doing so … as well as better communications between the parties in the 116th Congress.

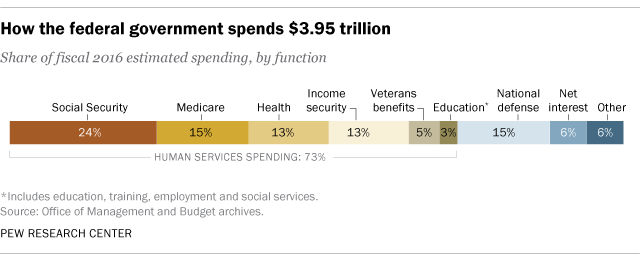

It’s instructive to understand the other side of the revenue-budget equation. Americans’ tax dollars in 2016 were spent on the following:

Saving Face

The U.S. and China are locked in a damaging, escalating trade war. President Trump has continued to apply his strategy of laddered increases in tariffs (as well as attacks on Chinese champions such as Huawei) in an effort to force China to make concessions that China is unwilling to make. At the moment, he has the support of the American people, but if it turns out that the Chinese can successfully absorb the economic pain of American tariffs, that support will wane as, over time, economic storm-waves rise for American businesses and consumers.

The following appeared on Twitter on May 15, 2019 from Hu Xijin, editor-in-chief of the Chinese and English editions of the Global Times: “In Chinese

internet, many people describe the current China-US tussle as The Art of the

Deal vs. On Protracted War. The latter was written by Mao Zedong in 1938 during China’s anti-Japanese war. Protracted war is well known among Chinese as a strategy to exhaust opponent.”

President Xi has absolute control over China. He has appointed himself President-for-life, eliminated rivals, and made himself the poster-leader for economic growth through an effective combination of mild economic liberalization, government-managed credit-easing, ruthless suppression of dissent, and tight control over social media and the internet. His overt nationalism has struck a strong chord with the Chinese people.

For his part, President Trump cannot afford to show weakness without endangering his 2020 re-election chances, although Trump has shown a willingness to reverse course without apparent political fallout in previous face-offs, including with North Korea, Mexico and Canada. His macho self-image also prevents him from running the risk of being perceived as having lost a face-off with President Xi. However, pressure on Trump will increase as the 2020 elections approach.

President Xi has somewhat greater latitude. China has more to lose from the Trade War, but arguably also has more global cards that it can play. Those cards include possible support for America in its confrontations with Iran and/or Venezuela and/or North Korea, as well as through economic trade-offs it might provide through its Belt and Road Initiative and its massive holdings of U.S. Treasuries. Yet, he cannot afford to be perceived as giving in to American tariffs and not receiving concessions in return without undermining the power he has amassed.

How can both autocratic leaders save face?

It is said that every crisis presents an opportunity as well as a danger. Both the opportunity and the danger clearly are present in the currently escalating Trade War. It nevertheless is within the power – and in the best interest – of both leaders to find a satisfactory solution. In addition to trade, the U.S. and China have been gearing up for conflict in other areas of global sensitivity as China’s rising presence has come face-to-face with America’s global hegemony (see “Red Storm Rising” in the April 12th TLR). Now would be an opportune time for the world’s number 1 and 2 powers to work out a multi-level solution that provides an actual and perceptual win-win, perhaps through a form of d├®tente in which both China and the U.S. work towards specified mutually-beneficial objectives. In any event, the U.S. and China must find a way to avoid a devolution of the current Trade War into a military confrontation, whether in the Western Pacific where both sides warships and military aircraft already face-off, or elsewhere. What the precise terms of a workable d├®tente might be are beyond the scope of The Lonely Realist. However, as Graham Allison sets out in his book, Destined for War, the alternative to d├®tente most likely is war.

Finally (from a good friend)

*┬® Copyright 2019 by William Natbony. All rights reserved.

No Comments