12 Jul Revenge of the Zombies!

Today’s TLR is about Zombies, real economic Zombies. Individuals, companies, and governments that are the walking undead – suffocated by mountains of debt, doomed to eventual economic oblivion. Many are unable to currently pay even the relatively modest interest they owe …, individuals without adequate income, businesses lacking sufficient profits, and State and local governments short on tax revenue. With the Federal government’s 21st Century printing press in overdrive, individuals, companies and States have received a license to take on ever-increasing debt … and they’ve been doing so. When pressed for payments, they roll over their existing obligations by borrowing more, expecting that they’ll be able to continue eating human flesh devouring cash amassing debt forever.

But everyone knows that the lifespan of Zombies, and of Zombie debtors, is limited.

Americans love debt. What red-blooded American doesn’t have a mortgage, and or a car loan, and or a student loan, and or an outstanding balance on his or her credit card … all wonders of modern finance? Why pay cash when borrowings are readily available at interest rates that are at historic lows? Borrow to the hilt! America’s businesses and corporations do it. They borrow to generate cash flow, they borrow to pay dividends, they borrow to pay salaries and bonuses, and they borrow to purchase other businesses laden with additional debt. Why not? It’s as close to free money as anyone is ever likely to see. The credit markets, the Federal Reserve, and Uncle Sam are there to provide the cash to finance everyone’s needs … and a host of additional desires.

The burden of those debts weighs most heavily on those at the bottom of the American economic pyramid …, although their Zombie debt is now relentlessly creeping its way up the economic ladder. Debt burdens on individuals affect their ability to consume … which reduces the profits of businesses … which impacts on State and local tax revenue as well as adding to State and local budget burdens … and then trickles its way back down as governments lay off workers, raise taxes and reduce services … in a potentially vicious downward spiral. To this slow-motion walk-of-debt-death, this Zombie walk, Covid-19 has added an accelerant.

The Covid-19 pandemic has suddenly vaporized service jobs and, in doing so, has impacted individuals’ incomes. Those affected necessarily will be unable to pay their debts, which already is affecting banks and banking profits …, and because many are now living hand-to-mouth, their consumer spending – and consumer spending in general – is beginning to dry up. The reduction in consumption is wiping out profits at a host of companies and, in many instances, has hobbled entire sectors. It’s not only Carnival Corp. and Marriott International and Delta Air Lines and Brooks Brothers and Hertz that have hit the skids. Corporations and small businesses across the nation have had to rely on the Federal Reserve to support credit markets and inject capital into a suddenly-frozen economy, and individuals and businesses have had to rely on the Federal government to subsidize their income and operations and, for many, their very existence. To avoid an unacceptable economic outcome, trillions of Dollars therefore have been helicopter-dropped on individuals and businesses all over America.

In order to support the economy and avoid cascading economic panic pain during the Covid-19 Crisis, State and local governments have temporarily suspended individuals’ and small businesses’ obligations to make mortgage and lease payments, hobbling both commercial and residential real estate owners. Court systems, already on overload, are so backed up that lenders, incentivized by government edict, necessarily are going easier on borrowers, forbearing collections on auto, credit card and small business loans. Government handouts under the Paycheck Protection Program …, and in the form of $1,200 stimulus checks …, and for increased unemployment insurance …, are allowing the substantial majority of Zombie individuals and companies to survive …, but these hand-outs will end. “The Cares Act and other swift government measures have been successful in keeping consumers afloat during the crisis” according to Amy Quackenboss, executive director of the American Bankruptcy Institute. “As this relief runs its course, however, mounting financial challenges may result in more households and companies seeking the shelter of bankruptcy.” At some point, without an end to the pandemic, out-of-work individuals will run out of money. At some point, existing debt loads will exceed individuals’ and corporations’ ability to repay. At some point, the Fed and the Federal government will have to stop their multi-trillion-Dollar printing. That not only will result in escalating and cascading bankruptcies and job losses, it also will gut catastrophically erode State and local governments’ tax bases and require those governments to reschedule or default on their debts.

Outside of the largest technology and entertainment companies, the economic pain is pervasive. Companies hardest hit by Covid-19 have tapped the markets for billions of Dollars in debt. They haven’t yet gone out of business. And yet appearances deceive. They are Zombies. They have a limited time remaining. Their debt loads are unsustainable. Corporate debts are being artificially serviced by the Federal Reserve which has pledged to keep Zombie debtors afloat. It’s using its full firepower to fulfill that pledge. But the Fed is not the market. It is merely supporting a broken debt market by buying junk bonds and corporate debt that a free market would shun. Never mind that business operations aren’t viable and may not become viable for many years … if at all. Never mind that profits are non-existent and profit forecasts are a pipedream.

Yet those are realities … and realities ultimately matter.

If profits are ephemeral, if individual and corporate debtors will default, and if Zombie businesses will fail, what is going to happen to the budgets – and the debts – of State and local governments? U.S. government debt can be serviced by printing Dollars. Not so for States and Cities – they don’t own printing presses and yet are required to fund public education, police and fire protection, social and medical services, paved roads, mass transportation, sanitation, etc., paying for those necessities by taxing their citizens. What happens if those citizens aren’t earning enough income? What if State and local governments are unable to provide services or repay their debts? Corporations and small businesses are not generating the profits they were a short six months ago. Many already have closed their doors. Although there is hope that certain closures will be temporary, local businesses have been running at a loss … if they’ve been running at all … and “furloughed employees” are all-too common. The swift reduction in business profits means that there will be little 2020 tax for State and City governments to collect. Restaurants, barber and beauty shops, gas stations, gyms, tattoo parlors and retail stores have been closed. Public events, concerts, plays and sporting events have vanished. Colleges are downsizing and suspending their sports programs. School systems are searching for funding to support a combination of social-distancing and computer-aided education. Tourism is dead and the monetary stimulus provided by foreign visitors, students and immigrants is vanishing. State and local employees who have the option of early retirement are taking it, adding unanticipated pressure to government budgets.

And yet there is a continuing belief that as long as the Fed keeps pumping money into the economy, as long as the Federal government keeps supporting businesses and providing subsidies to “furloughed” workers, all will be well. The Zombies will continue their business operations, individuals will continue to pay their debts and produce goods and services, and State and local economies will recover and thrive.

That’s an illusion.

States and Cities cannot survive economically under these circumstances (a reversal of the thesis advanced in the July 22, 2019 TLR, “The Big Blue Cities”). Although New York City has the highest income and sales tax in the nation and the strongest of business and individual tax bases, in 2019 it was forced to rely on Federal and State support to fulfill its budget obligations. NYC already has been compelled to cut its 2020 budget by over $7 billion … during a period of increasing Covid-19 expenditures. At the end of fiscal 2018, New York City had per capita debt of $10,600. How many New Yorkers are going to remain NYC residents if they have to support that additional debt? New York State is in even worse fiscal shape. The Trump Administration has repeatedly stated that the Federal government has no business bailing out State and local governments. How, then, can Big Blues find the necessary revenues to pay their bills? They can’t rely on tourism … or Broadway shows … or sports, concerts or conventions at their spacious stadium and convention facilities … or their tax collections from hotel rentals and retail sales … or from restaurant dining … or from real estate taxes on commercial and residential properties…. The value of those properties and businesses is sinking fast: the official NYC apartment vacancy rate hit a record 3.67% in June, but is probably far higher as those who can work remotely have been abandoning NYC and fleeing to the suburbs. States and Cities will have an exceedingly hard time collecting taxes from those who once worked locally and now work remotely. Businesses with the ability to relocate are doing just that. As a consequence, tax collections are at a threshold of collapse. Business profits are down … and in some cases out. States and Cities cannot replace their revenue … a reality that will not be temporary. More than 25% of Americans work at jobs that can be performed remotely. To the extent that employers decide to save on office and overhead costs, remote employment will become a part-of-21st Century working life and business operations.

State and local governments therefore will be strapped for cash. They will have to jettison workers, an action that will ripple through the American economy. Government services will be reduced, weighing on both businesses and individuals, spiraling into lower sales and income tax collections and pushing more workers onto the governments’ unemployment and medical care rolls in a self-reinforcing cycle …, which in turn will ripple into the repayment …, or non-payment …, of State and local Zombie debt.

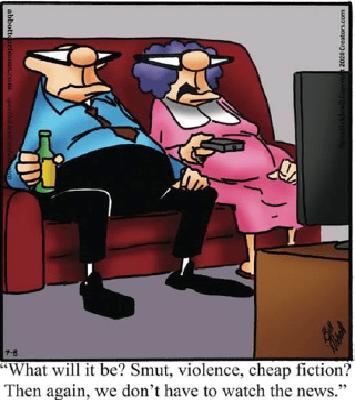

Finally (from a good friend)

*© Copyright 2020 by William Natbony. All rights reserved.

No Comments