12 Feb Seize the Moment!*

Seize the Moment!

The 2020 Presidential race pits profligate big-spending Democrats against the profligate big-spending Trump Administration. The one thing both political parties agree on is deficits – they both want more, not less. For a different set of reasons, each favors huge increases in America’s debt. What they disagree on is taxes. President Trump wants to lower tax rates by pyramiding the Tax Cuts and Jobs Act of 2017 – an application of Modern Monetary Theory that TLR has repeatedly highlighted (see, for example, “Will Modern Monetary Theory Work?” in the April 10th TLR and “They’re All Keynsians Now” in the March 27th TLR), and virtually all of his Democratic opponents want to reverse the tax cuts in the Tax Cuts and Jobs Act of 2017 and, as their pitch, add premium taxes on the wealthy. Neither party makes any pretense of reducing America’s insoluble growing debt burden … which currently stands at $23 trillion! Keynsian deficit spending – the printing of more-and-more Dollars – has been embraced by both parties. Unlimited spending is “in.” The enormous debt and deficit numbers are only going to get bigger! The voting public, however, doesn’t care about debts or deficits. It cares about taxes. It hates them! That’s especially true at this time of year. Voters see America’s tax system as unfair, overly complex, out-of-touch, a 20th Century relic that supports government profligacy and not their interests. And they’re right. America’s tax system was designed in the last Century for a very different America. Many of the industries that it was intended to benefit no longer exist. Those antiquated tax laws now distort economic activity, misallocate resources and reduce productivity. They were drafted by politicians bought pressured by the lobbyists wealthy contributors cronies special interests of the day. And they don’t address America’s unsustainable deficits. In fact, they do the opposite, making the future more-and-more uncertain for America’s next generations.

This creates an opportunity for a visionary politician who can embrace – and perhaps thrive because of – radical change. Why hasn’t one grabbed that opportunity? Why hasn’t a disrupter stepped up? President Trump embraced radical change when he ran in 2016. He’s living proof of the success that political disruption can bring …, and 2020 is an optimal time for a politician to modernize America’s antiquated tax system! It’s time for a Presidential candidate to Seize the Moment!

The Infernal Internal Revenue Code impacts everyone – every American, whether an individual or a business, and every foreign person who has any connection to or interaction with the U.S. Taxes permeate every facet of American life, every corner of the economy, and every international relationship. The Infernal Internal Revenue Code contains more than 4 million words, a count that doesn’t include the multi-volume Treasury Regulations drafted in a fruitless attempt to make sense of them. Let’s not forget the consequential State and local tax laws and regulations that pile complexity upon complexity during every American’s tax season, as well as wasting costing Americans’ time and money. The world’s arguably most important work, the Bible, has only 800,000 words. Everyone can access and understand the Bible. The Religious Reformation started 500 years ago. It’s time for a Tax Reformation!

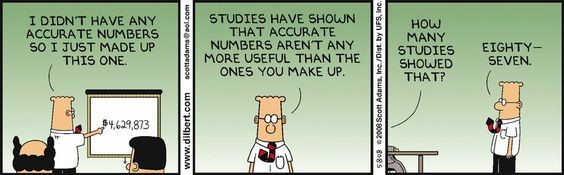

America’s tax system needs to complement American democracy, not confuse or politicize it. It needs to emphasize American values: efficiency, democracy, capitalism, and entrepreneurialism. Unfortunately, our tax laws are indecipherable to all but a relatively few tax professionals who, truth be told, add little or nothing to our nation’s productivity …, a depressing conclusion that, as a former law school tax professor, I can attest to. Our elected officials have not been motivated to simplify it or make it understandable or equitable. Quite the contrary. Doing so has not been a vote-getter. Significantly, our tax laws are so riddled with special benefits and subsidies that any change would upset one constituency or another, a vote loser … until now. Since 1986, the approach of Congress has been to play to the lobbyists special interests. How else is one to serve the people get re-elected? The Democrats are falling over themselves in their effort to tax the billionaire Fat Cats, something they wrongly believe will garner sufficient votes for them to replace the Trump brand of populism. The Trump Administration, smelling the blood of Democrats in the water, has adopted a tax-cutting line – cut and keep cutting to give everyone a free lunch. The Administration’s motto is that everyone needs to pay less taxes. Damn the deficits. Damn the consequences. Damn the complexity. Continue to support 20th Century industry. Pay attention to the special interests. One can only hope for a Churchillian Moment, for a visionary to step forward and capture the public’s imagination.

No Democratic candidate has risen to the challenge. No Democratic candidate has had the guts foresight to step forward with a tax proposal that embraces common-sense American values. And, yet, no Democratic candidate is likely to win the White House with a policy that boils down to an overly-simplistic slogan of “Tax the Billionaires!” … a policy that raises taxes for some without lowering taxes or alleviating tax complexity for the majority. Although that surely appeals to many perched on the left wing of the Democratic party, the majority of Americans want a simple tax system that relieves them of the burden of paying a significant portion of their hard-earned income to the government. They want something that they perceptively benefit from, something they can understand.

That tax plan already exists. It has been on full display in Washington, D.C. for more than a decade …, during which time it has been pilloried by the Washington swamp-dwellers because it would cost them campaign contributions. It ignores, and in some ways tramples on, the special interests who fund politicians’ reelection campaigns. It hasn’t been embraced by a visionary political leader (like it might have been by Ronald Reagan, who proposed and pressured Congress to enact major tax simplification in 1984-86), in large part for that reason …, and in part because it’s risky … in all the ways that today’s Americans ought to embrace. It should be especially attractive to a Democratic disrupter who wants to distinguish him- or herself from the leftists …, and capture the imagination of America’s voters.

It’s called the “Competitive Tax Plan” by its author, a law professor who spent most of his career perfecting and trying to sell the Plan to Congress. The CTP would shift America’s tax system from one based on income to one based primarily on consumption …, a shift that economists have been advocating for decades … and one that would incentivize entrepreneurialism and dampen consumption …, something that would spur exports and discourage imports – precisely what President Trump has said he wants to achieve …, and it would do so in an economically-constructive way without tariffs or trade wars.

The CTP would be revenue-neutral (although it could be geared to reduce current deficits) and would not change the overall income distribution … or it could be tweaked to provide lower effective taxes for the 99{29ea29b64b10057f61377b2c087cd5b7537a0cd24da4295a308b0bf589469f35} and higher effective taxes for the 1{29ea29b64b10057f61377b2c087cd5b7537a0cd24da4295a308b0bf589469f35} … or anything in between. In short, it could be “populist-ized”! As a revenue-neutral tax reform, the CTP would have five components:

- The most important would be a value-added (or goods-and-services tax) with a broad base and a single rate of ~12 percent. Businesses with less than $1 million in gross receipts would be exempt. There would be 18-24 months between enactment and implementation, which would be expected to accelerate purchases of durable goods and provide a short-term boost to the economy – precisely what a President or a Presidential candidate would want to promise. States would be given incentives to harmonize their tax policies with the Federal tax.

- Married couples with less than $100,000 in income ($50,000 for singles) would be exempt from income tax. Think of the savings in time and money that this would create! Think of the votes! Above this threshold, tax rates would be 14, 27, and 31 percent, also lower rates than those that exist today! The alternative minimum tax and surtax on investment income would be repealed. With these reforms, less than one-fifth of households that now pay income tax would be required to file returns. Think of the simplicity! Think of the votes!

- The corporate income tax rate would be reduced to 15 percent from the current 21 percent rate created in 2017. All credits except the foreign tax credit would be eliminated, and the corporate alternative minimum tax would be repealed, greatly simplifying the taxation of small businesses. Think of the savings in time and energy! Think of the votes!

- The current payroll tax would be modified to provide credits of 15.3 percent for workers with earnings up to $10,000 and a credit of $1,530 for workers earning between $10,000 and $40,000. The credit would phase out for incomes above $40,000.

- Refundable child credits would be established and distributed through debit cards. Each child would qualify for $1,500 per year, with a phaseout provision for higher-income earners. Low- and moderate-income earners, on the other hand, would receive an additional rebate of up to $3,500 for one child and $5,200 for two or more children.

The CTP would alter everyone’s perception of America as high-tax and high- cost. It would create a new business and investment reality and raise the business bar overnight, making the U.S. the most foreign investment- and business-competitive country on Earth, spurring a global renaissance in American capitalism and enhancing the global faith in the American system. The benefits to American power and influence would be immediate and measurable. Taxes on American wage-earners would be the lowest in the world (Workers of the World Unite!) and most Americans, including older Americans who depend on interest income, would pay no tax on their savings. The IRS no longer would be feared because its reach would be limited … primarily to a small minority of the wealthy. Think of the votes!

Such a radical plan would upset the order. But then, leadership needs to be made of stern stuff.

This is the ideal time for a far-sighted Presidential candidate to Seize the Moment! If not now, there may never be a better opportunity .

Finally (from a good friend)

*┬® Copyright 2020 by William Natbony. All rights reserved.

No Comments