06 Dec The Thanksgiving Crypto Crash

“Cassandra’s predictions are excessively pessimistic.” – The Lonely Realist

TLR spoke this week with the fabled Cassandra to question the recessionary forecasts advanced by the mythical oracle, most recently this past September.

TL Realist: Good morning, Cassandra. Because cryptos have been experiencing major pullbacks, I have been peppered with reader requests for an update on your economic views. You previously predicted that “America will continue experiencing a high level of economic volatility accompanied by economic contraction – stagflation at best.” Although there has been quite a bit of volatility, economic contraction has not (yet?) reared its ugly head. My readers and I value your legendary foresight and would like to better understand how you now view America’s economic future. We very much appreciate your willingness to share those insights.

CASSANDRA: Thank you, Mr. Realist. The pleasure is all mine.

TL Realist: As background, since reaching all-time highs 2 months ago, the prices of cryptos have been hammered. Bitcoin, the crypto industry bellwether, had a >30% decline (followed by a 10% rebound) [ED NOTE: Ethereum, XRP, Solana and Dogecoin suffered greater losses before rallying]. This has led some to conclude that crypto (finally) has started to crater, while others speculate about a second crypto winter that could bring down the financial system. What do you think?

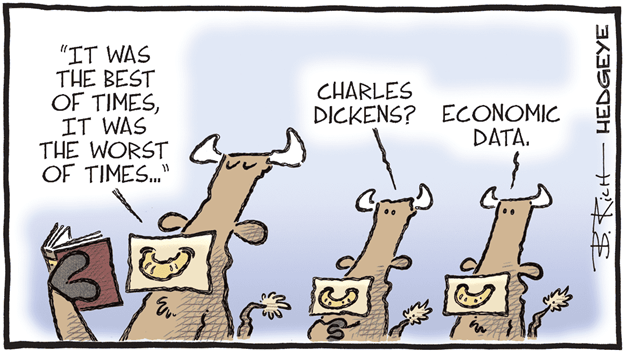

CASSANDRA (laughing): Take a deep breath, Mr. Realist. Tell your readers not to overreact to micro-news. We are living in macro-volatile times and crypto is simply a component of that volatility. Although recessionary forces are building, they have not reached a crescendo – you have misperceived my recessionary forecast. Recession indeed is baked into the global economy’s future. That is evidenced in part by increasing volatility. The recessionary impact will become manifest when governments cease excessive money-printing, become even more overly indebted, and cutbacks in public spending truly bite. Crypto therefore is both a symptom and a cause of today’s volatility, though it is not the only symptom or cause. There’s the stock market, which continues to levitate to unexpectedly new heights despite countless concerns about profitability and the reality of the Mag7 bubble. Tariff wars are stopping and starting with dizzying irregularity. Geopolitical storms show no sign of abating – in the Middle East, Ukraine, Sudan, Pakistan, perhaps Venezuela, etc. China, Japan, India and the EU each is facing a different set of economic pressures. And meanwhile, precious metals are climbing to ever-higher highs – silver this past week rose >20% in 4 days! What better evidence can there be of financial disquiet? The question, Mr. Realist, is not whether crypto is correcting or cratering or merely being crypto, but what crypto – and increasing volatility in everything – is signaling.

TL Realist: Point taken, Cassandra. And, yet, crypto was brought to life by President Trump who imbued it with superpowers. Paul Atkins, appointed as SEC Chairman by the President early this year, pledged to “unleash [on America] the transformative potential of digital asset technology,” his goal being “to modernize the securities rules and regulations to enable America’s financial markets to move on-chain.” In doing so, the Trump administration placed crypto at the heart of America’s financial industry. Its importance therefore cannot be overstated. The last time crypto crashed was in 2022. Although that crash had virtually no effect on America’s financial system, that was when Donald Trump believed that crypto was “based on thin air” and seemed “like a scam.” That has seemingly been reversed under Trump 2.0.

CASSANDRA: Crypto indeed has greater importance today than it did in the past. It may indeed prove to be the spark that ignites a fire under the entire financial industry. However, that misses my point. Whether it’s crypto (because of a future crash in the price of Strategy Inc. or for other reasons) or geopolitics or AI or a reversal in the Japanese carry trade or etc., the global economy is facing significant headwinds. It is slowing. A spark can come – and will come in time – from any one or more of many possible sources. The current crypto correction is not of sufficient significance.

TL Realist: Your prediction, Cassandra, relies on your immutable belief that human nature requires that mere mortals repeat their mistakes, that whatever human beings did in prior eras they will do again, that homo sapiens need not make identically bad decisions, but necessarily will continue making similarly bad decisions that “rhyme” with their prior patterns of poor decision-making. Your construct mirrors the economic cycle theory favored by Ray Dalio and others. A recent analysis by The Economist, however, challenges that concept. It concludes that government interventions have been increasingly successful in deferring and mitigating the impact of adverse economic events and, as a consequence, have led to rarer and milder recessions (and to an unprecedented ~100 consecutive years without a depression). That’s a trend, Cassandra. As I noted more than 5 years ago (in April 2020), “No one knows where the combination of Modern Monetary Theory, new economic policies, political and social upheavals, and maturing revolutions in agriculture, industry, technology and biotechnology will take us. No one can know.” Add snowballing AI advances to this heady mixture, and perhaps this time indeed may be different, Cassandra.

CASSANDRA (laughing): I am the oracle of oracles, Mr. Realist. I know. I have identified a bubble and foreseen that it will burst in the not-too-distant future. The evidence of excess is obvious. As your article from The Economist notes (quoting Joseph Schumpeter), “Depressions are not simply evils, which we might attempt to suppress. [They represent] something which has to be done.” That’s an incontrovertible economic fact. You counter with a timeworn “This time is different,” parroting the title – but not the conclusion – of a book by your fellow mortals, Carmen Reinhart and Kenneth Rogoff, economists of high repute who explain why financial crises are not unique occurrences – they necessarily recur – and why no time ever is different. “This time is different” has been the futile rallying cry of homo sapiens for the past 4,000 years. Human nature is never different, Mr. Realist. Recessions are inevitabilities, and it is my foresight that has revealed why America soon will experience one.

TL Realist (also laughing): Time will tell, Cassandra. Many thanks again for your time and your perceptive insights.

Finally (from a good friend)

No Comments