08 Aug Inflation: Just a Blip?

“Prices of homes, rental units, employees, healthcare, autos, food, staples, transportation, commodities, etc., are rising. Is there anything that isn’t politicized in 21st Century America?” – The Lonely Realist

The inflationary picture (as well as almost everything else in America’s economy) rests in the capable hands of the Federal Reserve. Will inflation take flight as many are speculating? or will inflation be transitory as Fed Chair Jerome Powell has promised anticipates? A TLR commentary in early June adopted the position of the Fed Chair in arguing that inflation could turn out to be a transient blip. A subsequent TLR commentary in late June advocated the opposite, predicting that inflationary pressures would increase through at least the end of 2022. It also cautioned that making predictions about the future is a hazardous business with precious few economic oracles having a demonstrated record of success. As noted by Amos Tversky, “It’s frightening to think that you might not know something, but more frightening to think that… the world is run by people who have faith that they know exactly what is going on.” TLR does not pretend to any such knowledge. Chillingly, the Federal Reserve and America’s elected officials apparently do (although Fed Governor James Bullard recently admitted that the US economy “is in an environment where we’ve got a lot of volatility, so it’s not at all clear that any of this will pan out the way anybody’s talking about”).

Milton Friedman asserted that the cause of inflation is “always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” America’s 13-year-long orgy of money-printing most certainly fits the definition of “rapid increase.” It also is one that has far exceeded output. However, history shows that inflation requires an additional impetus in order to take flight. Some believe that such an impetus already has been provided by

- The Trump Administration’s 2020 addition of $2.6 trillion of stimulus and $900 billion of tax relief;

- A budget deficit of $3.1 trillion;

- The Fed’s addition of >$3 trillion of COVID-triggered lending and bond-buying;

- The 2021 $1.9 trillion of Biden Administration stimulus; and

- The likely passage of its $1 trillion infrastructure bill.

Yet, even those grossly-expansionary doses of money-printing will result in inflation only if producers and consumers believe that prices will continue to rise (in a self-feeding cycle of demand and supply) …, an expectation that both the Biden Administration and its politicized Fed are trying to neutralize by managing anti-inflationary messaging …, although at the same time each is trying to generate actual inflation of at least 2%, a 13-year goal that, until recently, eluded them. The Biden Administration has been doing its part by generating wage inflation through provisions included in its $1.9 trillion stimulus bill and through its June Executive Order that favors worker compensation over employer profit by striking at so-called “anti-competitive practices.” The Fed has been the government’s cheerleader for “short-term, moderating inflation” via an avalanche of dovish statements about both the transitory nature of rising inflationary pressures and its assurance that there will be no need to raise interest rates until 2023. Among other things, Chairman Powell has said that “it would be a mistake” to tighten monetary policy “at a time when virtually all forecasters” believe that inflation “will come down” on its own. Making his point, the Fed expanded its reverse-repo borrowing to an unprecedented $1.04 trillion at the end of July from $272 billion in April, pulling $750 billion of liquidity out of the financial system while continuing its $120 billion monthly purchases of Treasurys and mortgage-backed securities.

What began in 2009 as the Federal Reserve’s emergency response to the Global Financial Crisis has continued with massive money-printing, unprecedented fiscal spending, immense stimulus measures, and bond and stock buying that dwarfs those of any other period in recorded history …, with history books littered with the consequences of even a few such policies. The longer these policies last, the more ingrained they become, the more durable their effects, and the more expensive and extensive their costs. Their length and extent indicate that, unless countermeasures are taken, the American economy will, at some future date, fall off a fiscal cliff … and time is running out. A most significant consequence will be Dollar debasement and forfeiture of reserve currency status, an end to the “exorbitant privilege” that reserve currency status has bestowed on America. All of the ingredients for debasement are present today: fiscal and monetary extremes; historically-unprecedented interest rates that are hundreds of basis points lower than those that in 2002-04 blew-up the bubbles that burst during the Global Financial Crisis; and a backdrop of 13 years of Quantitative Easing and money-printing. With the year-on-year Consumer Price Index increasing by 4.2% in April, 5% in May, and 5.4% in June, the trend is up …, and both the crowdsourced inflation estimate for July (the official CPI will be released on August 8th) and the Institute for Supply Management (ISM) report released this past week indicate that the inflationary trend will continue (the Chair of ISM even stated that “the Federal Reserve has said that this looks to be transitory as it relates to inflation. Well, I can tell you these prices where they are now they’re not going away anytime soon.”).

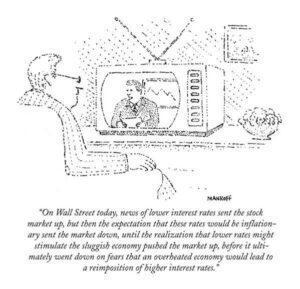

The Federal Reserve has been “sweet-talking-the-talk” by saying whatever it takes to keep the genies of inflation, recession and bubbling assets in their bottles, thereby allowing pressures to build. Although it is talking the anti-inflation talk, it understandably cannot walk any such walk without a political and economic backlash …, and Chairman Powell has been quite clear in his dealings with both President Trump and President Biden that he has no desire for backlash (especially now with the date for his reappointment being early 2022 …, and Lael Brainard as his more-dovish rival). Any action the Fed takes could have momentous economic and political consequences, and the current Administration has no appetite for the sort of economic calamity that could impact its chances in the 2022 and 2024 elections. From a political perspective, actual tapering or tightening therefore is not on Chairman Powell’s action list. In fact, the opposite is the case. Should cracks form in the stock market, in real estate or in the general economy and begin to widen, or should COVID-19 begin to weaken the economic recovery, the Fed most likely will choose to lower interest rates, adopt additional rounds of QE, and/or engage in further money-printing. Although the Fed may continue to talk-the-talk of tapering, it learned about taper tantrums in 2013 and understandably has little desire to again attempt walking any such walk.

There accordingly is no sign that the Fed or the Biden Administration will take steps to address inflation over the next ~16 months. To the contrary, each is making every effort to cover-up inflationary trends. For example, the Fed keeps changing the measurements for calculating CPI, not coincidentally in the direction of minimizing the reported rate. Changes in the rate for theoretical improvements in productivity already have resulted in a markdown, and CPI now also includes the concept of owners’ equivalent rent, an incomprehensible “mean reversion” adjustment, and a modification that substitutes alternative goods and services for goods and services with rapidly-rising prices. Both Political Parties have justified their laissez-faire approach to deficits and inflation based on the belief that increased costs can be offset simply and effectively by the printing of money to pay for the needs of the economy and their constituents, a fantastical application of Modern Monetary Theory. TLR has disagreed. The economic cliff will come into view – both for America’s politicians and for its citizens – only when the public-at-large begins to understand that the money being printed has a declining value – that is, when inflation has sufficiently debased the Dollar that people question its relative value versus the Euro, the digital Chinese Yuan, Bitcoin, gold, etc. Such a confidence implosion would mark the beginning of hyperinflation, the end of the Dollar as the world’s reserve currency, and an inevitable slide down in Americans’ standard of living.

Today, Americans are facing a set of government policies that are unique (this time indeed is different), too many of which are inflationary and include unique deficits, debts, monetary policies, economic extremism and unpayable future promises. Any endgame for inflation will require either tapering or the tightening of interest rates … or both. Such action would shock America’s stock market, result in a decline in the value of hard assets (including real estate), and trigger a recession, all of which would be unpalatable (in the extreme) to the Political Party in power. The economic cycle hasn’t been repealed. It has, however, been distorted. Most economic oddsmakers accordingly are betting on accelerating inflation (although others are betting the other way).

Finally (from a good friend)

No Comments